cazinobitcoin.site

Gainers & Losers

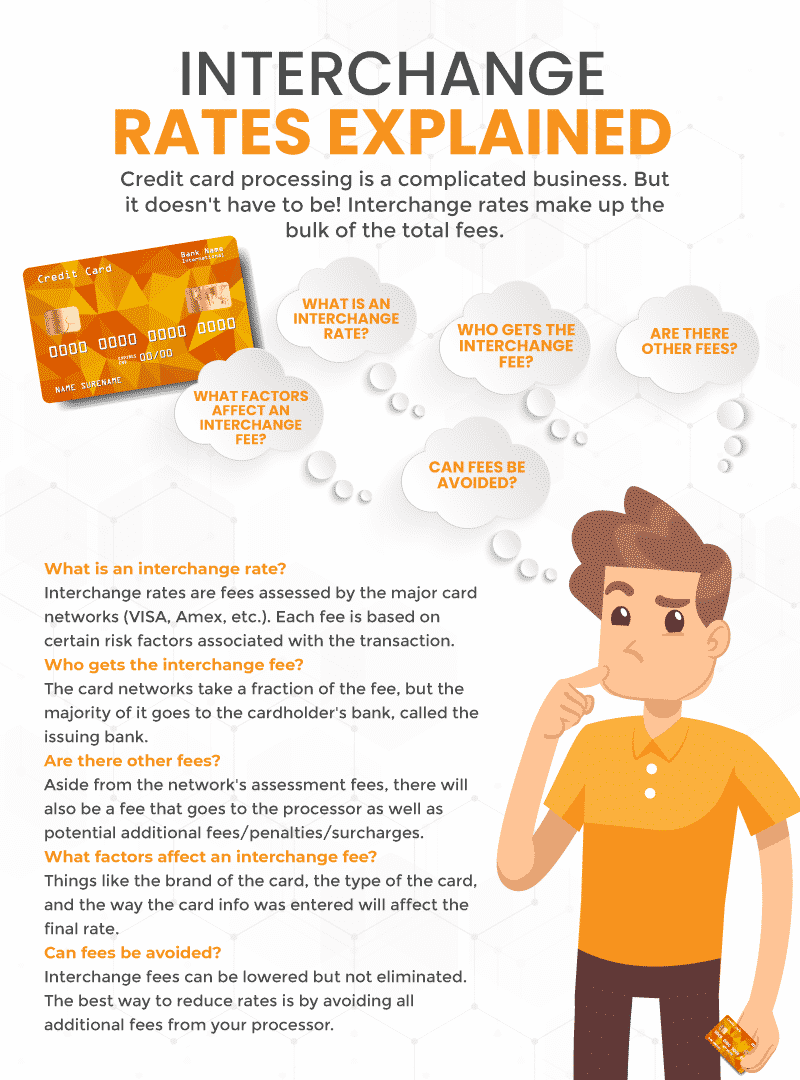

Interchange Costs

Interchange refers to a set of categories that are used to determine the rates for individual card transactions. A small percentage of that transaction will be used as a fee to pay the issuing bank (the customer's bank). This fee is called an interchange fee. Mastercard interchange rates are the transaction fees paid by acquirers to card issuers. Learn more about how the rates are determined & updated for the. Interchange fees refer to the base credit card processing fees set by the major card networks. It's the cost of doing business to accept credit cards. The fees are paid to the card-issuing bank to cover handling costs, fraud and bad debt costs and the risk involved in approving the payment. Interchange fees are the biggest part of the cost you will have to pay for processing transactions, usually comprising around 70% to 85% of the total fees. Interchange is the fee that credit card companies like Visa and Mastercard charge businesses to accept their cards. An interchange fee is a payment processing fee the card network determines and the issuing bank collects. This fee is non-negotiable and the responsibility of. Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card-based transactions. Interchange refers to a set of categories that are used to determine the rates for individual card transactions. A small percentage of that transaction will be used as a fee to pay the issuing bank (the customer's bank). This fee is called an interchange fee. Mastercard interchange rates are the transaction fees paid by acquirers to card issuers. Learn more about how the rates are determined & updated for the. Interchange fees refer to the base credit card processing fees set by the major card networks. It's the cost of doing business to accept credit cards. The fees are paid to the card-issuing bank to cover handling costs, fraud and bad debt costs and the risk involved in approving the payment. Interchange fees are the biggest part of the cost you will have to pay for processing transactions, usually comprising around 70% to 85% of the total fees. Interchange is the fee that credit card companies like Visa and Mastercard charge businesses to accept their cards. An interchange fee is a payment processing fee the card network determines and the issuing bank collects. This fee is non-negotiable and the responsibility of. Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card-based transactions.

How much are interchange fees? On average, interchange fees for credit card purchases are around % of the transaction value. Rates for debit cards are lower. Interchange fees are transaction fees from card payments between banks. Examples of this include fees from a retailer's bank account to a cardholder's. Interchange fees are charges that merchants pay to card-issuing banks for processing credit card transactions. Credit card interchange fees are avoidable, yet businesses still dole out up to % of every credit card transaction to the issuing bank. These merchants aren'. Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card-based transactions. Interchange fees are around % of the transaction amount in Europe and 2% in the US. Card schemes determine interchange fees and are non-negotiable. Credit card processing fees; Flat rate pricing; Interchange plus pricing; Tiered pricing; Deciding which structure is right for your business. Everything you. Interchange is a small fee paid by a merchant's bank (acquirer) to a cardholder's bank (issuer) to compensate the issuer for the value and benefits that. Interchange is the fee collected by the credit card brand and issuer on every credit card transaction. Merchants pay interchange fees. These interchange. Interchange fees, sometimes called “swipe fees,” cover the costs of accepting, authorizing, securing, and processing card transactions. They are also negotiable. Visa provides its partners with insight into the Visa Rules. Learn about merchant credit card processing fees, interchange rates, and rules for partners. Despite the exemption for institutions under $10 billion, per-transaction interchange revenue to credit unions and community banks has dropped by 10 percent and. What Are Interchange Rates? Credit card interchange fees are fees paid by a merchant's bank (acquiring bank) to the cardholder's bank (issuing bank) every time. How much are interchange fees? On average, interchange fees for credit card purchases are around % of the transaction value. Rates for debit cards are lower. What are interchange fees? Interchange fees are what the issuing bank charges merchants for the convenience of seemingly instant deposits. They're designed to. Intra Visa Europe interchange fees - European Economic Area (EEA). Rates applicable to Visa Europe transactions where both the card is issued and the merchant. Understanding Merchant Discount Rate (MDR) and interchange fees. Merchant Discount Rate (MDR) is a fee charged by acquirers for card payment processing services. Interchange fees are calculated as a percentage of the transaction. The percentage is based on EU regulations, the type of card used, and the fee set by the. Typically, interchange rates take the form of a percentage applied to sales volume plus a dollar-amount per transaction—for example, % + $ (this is. Read our guide on interchange rates and fees for merchants. Includes the most common interchange rates for the major card brands.

Does Getting A New Credit Card Hurt Your Credit

If your goal is to get or maintain a good credit score, two to three credit card accounts, in addition to other types of credit, are generally recommended. This. We never recommend closing a credit card for the sole purpose of raising your FICO Score. The decision to close down credit cards depends on your reasons for. Applying for and opening a new credit card may cause a temporary dip in your credit scores. Getting pre-approved for a credit card only requires a soft inquiry. If your credit score is lower than you'd like, a store credit card might be a useful tool. For starters, they're usually easier to get approved for than other. Even though applying for a new credit card will immediately impact your credit score, it will go back up over time as long as you pay your balance on time and. The total number of credit card accounts you have does not necessarily play a direct role in your overall score. However, having multiple credit cards can. Depending on your payment behavior after you open up your new card, your credit score will either increase or decrease. If a cardholder continues to make their. The short answer: It depends. It's true, opening a new credit card can sometimes give your score a big boost. And sometimes it's the best thing to do. Opening new credit lowers the average age of your total accounts. This, in effect, lowers your length of credit history and subsequently, your credit score. New. If your goal is to get or maintain a good credit score, two to three credit card accounts, in addition to other types of credit, are generally recommended. This. We never recommend closing a credit card for the sole purpose of raising your FICO Score. The decision to close down credit cards depends on your reasons for. Applying for and opening a new credit card may cause a temporary dip in your credit scores. Getting pre-approved for a credit card only requires a soft inquiry. If your credit score is lower than you'd like, a store credit card might be a useful tool. For starters, they're usually easier to get approved for than other. Even though applying for a new credit card will immediately impact your credit score, it will go back up over time as long as you pay your balance on time and. The total number of credit card accounts you have does not necessarily play a direct role in your overall score. However, having multiple credit cards can. Depending on your payment behavior after you open up your new card, your credit score will either increase or decrease. If a cardholder continues to make their. The short answer: It depends. It's true, opening a new credit card can sometimes give your score a big boost. And sometimes it's the best thing to do. Opening new credit lowers the average age of your total accounts. This, in effect, lowers your length of credit history and subsequently, your credit score. New.

Opening a new credit card while buying a house can jeopardize your home purchase because it lowers your credit score. Learn more here. This can increase your utilization rate or your balance-to-limit ratio, which in turn will temporarily lower your credit score,” says Rod Griffin, senior. If you've ever opened your wallet and wondered how you've managed to collect so many credit cards, you might also have asked yourself, “Does closing a credit. By contrast, applying for numerous credit cards in a short period of time will count as multiple hard hits and potentially lower your score. "Soft" hits—. LPT: Closing a credit card actually hurts your credit score because it effects your credit utilization ratio, making getting new debt in the. Frequently applying for new credit can hurt your credit score, so make sure you really need that new card before you apply for it. 2. Fact: Paying less than. Why it matters Getting a new credit card can both help and hurt your credit score, so it's important to be strategic. Research shows that people who open. When you apply for a new credit card, your credit scores might temporarily drop. Hard credit checks, which happen when lenders review a person's credit. Will getting a new credit card hurt my score? Obtaining a new credit card will likely result in a minor, temporary drop in your credit score due to the hard. The total number of credit card accounts you have does not necessarily play a direct role in your overall score. However, having multiple credit cards can. Applying for a new card will trigger a “hard inquiry” of your credit report, and will result in a drop. How big of a drop will depend on how. Does Applying for a Credit Card and Not Getting Approved Hurt Your Credit? Your credit will be affected whether or not you're approved for a credit card. Closing a new account will have less of an impact. To keep your credit score in good standing, it's important to remember to stick with a low balance that can. Opening a new credit card can have the same effect on your credit utilization ratio as securing an increased credit limit on an existing card. That means it's. The amount of debt you owe on your credit card is one of the biggest factors affecting your credit score. Generally, it's not a good idea to max out your. The good news is that the sections that benefit are weighed heavier than the sections that get damaged. Once you apply for a new credit card, the bank will. A soft inquiry doesn't affect your score at all, whereas a hard inquiry will leave a mark on your credit. Credit Damage Rating: Minimal damage. Closing an. This may impact your credit score. If your application is declined or you reject your offer, your credit score isn't impacted by the soft inquiry associated. They don't necessarily hurt your credit more than any other credit card, but what you do with the card can end up having a negative impact on your credit scores. Will getting a new credit card hurt my score? Obtaining a new credit card will likely result in a minor, temporary drop in your credit score due to the hard.

Credit Cards With Gas Rewards

Read reviews, advice, and recommendations from Bankrate credit card experts on the best gas credit cards for You can do better with gas rewards credit cards that offer you cash back or points on purchases at gas stations. Save money on your everyday gas purchases. The Citi Custom Cash® Card, Blue Cash Preferred® Card from American Express and Wells Fargo Autograph℠ Card are some of the most popular gas cards. Some users. With the Bank of America® Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other purchases. The Citi Custom Cash® Card, Blue Cash Preferred® Card from American Express and Wells Fargo Autograph℠ Card are some of the most popular gas cards. Some users. The right gas credit card can offer you as much as 4% cash back at the pump, and potentially even more valuable travel rewards. Gas Rewards Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Citi Custom Cash® Card · Citi Rewards+® Card · Capital One SavorOne Student Cash. As a Cardholder you will now be able earn 3¢ on every fuel purchase when you swipe your card to pay or save 5¢ per gallon in Rewards when you pay with the. The Exxon Mobil Smart Card+ gas credit card gives you instant savings at the pump, plus fuel rewards and convenience store savings. Get the best gas credit. Read reviews, advice, and recommendations from Bankrate credit card experts on the best gas credit cards for You can do better with gas rewards credit cards that offer you cash back or points on purchases at gas stations. Save money on your everyday gas purchases. The Citi Custom Cash® Card, Blue Cash Preferred® Card from American Express and Wells Fargo Autograph℠ Card are some of the most popular gas cards. Some users. With the Bank of America® Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other purchases. The Citi Custom Cash® Card, Blue Cash Preferred® Card from American Express and Wells Fargo Autograph℠ Card are some of the most popular gas cards. Some users. The right gas credit card can offer you as much as 4% cash back at the pump, and potentially even more valuable travel rewards. Gas Rewards Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Citi Custom Cash® Card · Citi Rewards+® Card · Capital One SavorOne Student Cash. As a Cardholder you will now be able earn 3¢ on every fuel purchase when you swipe your card to pay or save 5¢ per gallon in Rewards when you pay with the. The Exxon Mobil Smart Card+ gas credit card gives you instant savings at the pump, plus fuel rewards and convenience store savings. Get the best gas credit.

Gas cards often offer rewards such as cash back, discounts, loyalty points or discounts on fuel. If gas is a large spend category for you, it may make sense to. The CITGO Rewards Card is great for everything automotive, from gas to repairs! When you open a CITGO Rewards Card account, you will save or earn 30¢ on every. Citi Rewards+® Card: Best feature: Two points per dollar spent at gas stations. Chase Freedom Unlimited®: Best feature: Flexible cash back rewards. Ink Business. Some of the best cash back credit cards for gas are the American Express Blue Cash Everyday® and Blue Cash Preferred® cards, as well as the USAA. Some of the best cash back credit cards for gas are the American Express Blue Cash Everyday® and Blue Cash Preferred® cards, as well as the USAA. Gas Rewards Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Citi Custom Cash® Card · Citi Rewards+® Card · Capital One SavorOne Student Cash. 61% of people think gas rewards credit cards are a good way to save money on fuel purchases. Learn more from our complete Gas Credit. One of the best credit cards in Canada for gas purchases is the SimplyCash ® Preferred Card from American Express Card. With this card, you get 4% cash back on. The Phillips 66 business credit card is optimized to allow small business owners to manage and control their fuel purchases. Unlike an American Express card. JOIN: Join the Fuel Rewards® program and save 5c/gal on every fill up with Complimentary Gold Status · SWIPE OR ENTER ALT ID: Swipe your Fuel Rewards® card or. Citi Strata Premier℠ Card · Best Flexible Rewards Gas Card. Excellent, Good · 70, bonus points ; Citi Rewards+® Card · Best Gas Card With Points Rebate. With 5x the rewards at grocery stores, restaurants, and bars, the American Express Cobalt Card is the perfect credit card not just for millennials. With Amex. As a Cardholder you will now be able to earn 3¢ per gallon in Rewards on every transaction when you swipe your card to pay or save 5¢ per gallon in Rewards when. Save 30 ¢ /gal * (up to 35 gallons*) on your first 5 Shell fuel purchases made by 4/30/ New accounts only. Apply by 12/31/ Wherever your next trip is headed, the BPme Rewards Visa card could help you earn and save with daily rewards like cash back, gift cards to your favorite places. Rewards: Using credit cards at gas stations can offer you rewards for those purchases. The rewards you earn depend on the type of card and rewards program you. Carry a Balance · Ongoing savings of up to 6¢ per gallon at Shell stations based on the number of gallons purchased in a billing cycle · Revolving credit · No card. Credit One Bank® Credit Card with Gas Rewards See the online credit card applications for details about the terms and conditions of an offer. Reasonable. Credit Cards. Apply online today. Earn 5 cents per gallon in Rewards when you pay using your card in the Fuel Forward™ App. Or earn 3 cents per gallon in. Platinum status members will receive 10 ¢/gal in Fuel Rewards® savings on every fill-up at participating Shell stations. This will be combined with other.

Best Way To Lose 15 Pounds In A Week

How can you overcome a weight-loss plateau? · Reassess your habits. Look back at your food and activity records. · Cut more calories. Further cut your daily. Diet is great, but diet combined with exercise is the best way to lose weight healthy and maintain it as well! And yes, lots of water!!!! Reply. Flag. Hide. Don't eat anything after 6pm, good habit regardless of weight loss as it helps with gastric issues. Mix lifting weights, Zumba, cardio and leg. Keep track of your current caloric intake. One pound is equal to 3, calories, so to lose 1–2 pounds a week, you need to eat – calories less per day. With that in mind, if you consistently eat at a deficit of calories a day you can expect to lose a pound a week, which is a good number to aim for. Losing. I would look in the regulation and show whatever chain of command is telling you that they need to lose 15LBS that fast before you make a PT. Cut calories severely. You need to reduce your calorie intake by about calories per day to lose about pounds per week. Aim for Combine Strength Training and Cardio Regular exercise is an important part of any program to lose 15 pounds, but starting slowly is key if you haven't been to. To lose 15 pounds in 2 weeks, try to eliminate sugar and carbohydrates, like bread and pasta, from your diet as much as you can. Instead, eat lots of lean. How can you overcome a weight-loss plateau? · Reassess your habits. Look back at your food and activity records. · Cut more calories. Further cut your daily. Diet is great, but diet combined with exercise is the best way to lose weight healthy and maintain it as well! And yes, lots of water!!!! Reply. Flag. Hide. Don't eat anything after 6pm, good habit regardless of weight loss as it helps with gastric issues. Mix lifting weights, Zumba, cardio and leg. Keep track of your current caloric intake. One pound is equal to 3, calories, so to lose 1–2 pounds a week, you need to eat – calories less per day. With that in mind, if you consistently eat at a deficit of calories a day you can expect to lose a pound a week, which is a good number to aim for. Losing. I would look in the regulation and show whatever chain of command is telling you that they need to lose 15LBS that fast before you make a PT. Cut calories severely. You need to reduce your calorie intake by about calories per day to lose about pounds per week. Aim for Combine Strength Training and Cardio Regular exercise is an important part of any program to lose 15 pounds, but starting slowly is key if you haven't been to. To lose 15 pounds in 2 weeks, try to eliminate sugar and carbohydrates, like bread and pasta, from your diet as much as you can. Instead, eat lots of lean.

Ready to find out how to lose 15 pounds in 28 days? Let's go. Step 1: Be in This will shred pounds of fat every week, for the first four weeks. If you do not reduce your intake but walk enough to burn calories each day, you will lose a pound a week. Use an exercise journal to help you determine how. It has been four weeks since I started my fitness challenge. After gaining 15 to 20 pounds of extra weight over the past two years. This is a great way to reduce your overall calorie intake, which can help you lose weight. If you're thinking about trying intermittent fasting, it's important. How to lose weight in 6 simple steps · 1. Eat protein, fat, and vegetables · 2. Move your body · 3. Eat more fiber · 4. Eat mindfully · 5. Stay hydrated · 6. Get. How I lost 15 pounds in 90 days. More importantly, how I'm maintaining a weight that I love! · 1. I break my fast in a healthy way. · 2. I traded soda for water. If this type of weight loss is suitable for your condition, it will take a lot of self discipline and determination to lose 15 pounds in a month. You will have. Count calories: Weigh and log the foods you eat. · Eat only at meals: Reduce all snacks and don't eat anything after dinner. · Cut your condiments. King adds: “In my experience, the easiest way to sneak fat loss work into your routine is through the use of circuits and complexes. Nobody really wants to. Aim to cut back on calories and/or burn more to the tune of: calories per day for a half-pound loss per week, calories for a goal of losing a pound a. Here are the 7 steps you should follow in order to lose 10 pounds in a week. You can lose several pounds by following a low-carb diet for just a few days. In order to achieve this, you'll need to create a significant calorie deficit through a combination of diet and exercise. A healthy rate of. Drink water or other sugar-free drinks to quench your thirst. Choosing nonfat or low-fat milk is also a good idea. Start small. Small changes are a lot easier. This is a great way to reduce your overall calorie intake, which can help you lose weight. If you're thinking about trying intermittent fasting, it's important. Ready to find out how to lose 15 pounds in 28 days? Let's go. Step 1: Be in This will shred pounds of fat every week, for the first four weeks. Dating back to , this fad diet claims a weight loss of about 10 pounds or kgs in a week. The diet makes robust claims of faster and significant weight. Steve Cha (aka Rockstar Eater) spends 4 weeks trying to lose weight. His goal is 15 pounds in 30 days! Since the covid pandemic started in. Drink water or other sugar-free drinks to quench your thirst. Choosing nonfat or low-fat milk is also a good idea. Start small. Small changes are a lot easier. Do at least minutes of aerobic exercise 5 or 6 days a week. Go for a jog, run, bike ride, or briskly walk to burn extra calories each day. While what you. How to lose 15 pounds in 2 weeks · Mindful Eating. Practicing mindful eating can be a game-changer when it comes to weight loss. · Portion Control.

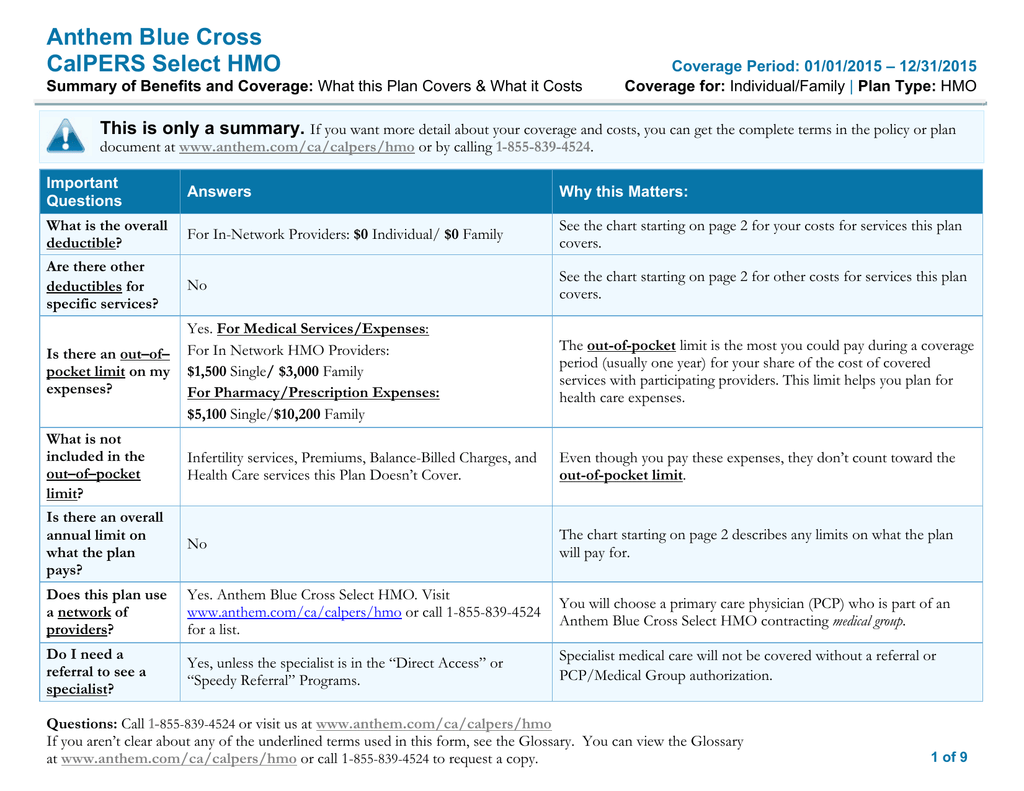

Best Anthem Blue Cross Plan

Choosing a personal plan is an important decision—and we can help. Use our health and dental benefit selection tool to find out which plan is right for you. Find coverage J.D. Power rated #1 in Michigan for Commercial Health Plan Member Satisfaction. Explore group, individual, Medicare and more. Enroll today. I would do a lower premium higher ded if you're a low utilizer. Do an HSA plan and max it out. With an overview of health, your employees will be empowered to make better decisions about their overall health journey. Blue Cross Blue Shield Association. Some people are even surprised they are separate carriers. What is the relationship? More importantly, which is better and why? All good questions and answers. This is a summary of the features of the Blue Cross and Blue Shield Service Benefit Plan. We use cookies on this website to give you the best experience and. Personalize benefits to top up provincial health plans, including prescriptions, dental, vision and hospitals. plan best aligns with your requirements for health coverage. Shop Gold Independent licensees of the Blue Cross and Blue Shield Association. Sydney. Platinum plans have the highest monthly premium, but the lowest out-of-pocket costs. These plans are best for those individuals and families who require ongoing. Choosing a personal plan is an important decision—and we can help. Use our health and dental benefit selection tool to find out which plan is right for you. Find coverage J.D. Power rated #1 in Michigan for Commercial Health Plan Member Satisfaction. Explore group, individual, Medicare and more. Enroll today. I would do a lower premium higher ded if you're a low utilizer. Do an HSA plan and max it out. With an overview of health, your employees will be empowered to make better decisions about their overall health journey. Blue Cross Blue Shield Association. Some people are even surprised they are separate carriers. What is the relationship? More importantly, which is better and why? All good questions and answers. This is a summary of the features of the Blue Cross and Blue Shield Service Benefit Plan. We use cookies on this website to give you the best experience and. Personalize benefits to top up provincial health plans, including prescriptions, dental, vision and hospitals. plan best aligns with your requirements for health coverage. Shop Gold Independent licensees of the Blue Cross and Blue Shield Association. Sydney. Platinum plans have the highest monthly premium, but the lowest out-of-pocket costs. These plans are best for those individuals and families who require ongoing.

Blue Cross Blue Shield has strong ratings and offers a variety of quality, affordable health insurance plans, making it our top pick as the best overall health. Marketplace plans are put into 4 categories (or "metal levels"): Bronze, Silver, Gold, and Platinum. Catastrophic plans are a 5th category available to people. Explore Blue Shield of CA Individual and Family healthcare HMO and PPO plans for medical, dental, vision and life coverage. Our mission is to improve the health of the people we serve. At Anthem, we believe the best health care coverage can actually help people stay healthy. That's. Shop for individual and family health plans at Anthem Blue Cross Blue Shield. Find health, dental, and vision coverage today, or visit cazinobitcoin.site to learn. Anthem Blue Cross · 1 Platinum HMO plan · 1 Platinum PPO plan · 3 Gold HMO plans · 6 Gold PPO plans · 3 Silver HMO plans · 4 Silver PPO plans (includes two HSA. Kaiser Permanente: Best health insurance. Blue Cross Blue Shield: Best health insurance for the self-employed. UnitedHealthcare: Best health insurance. Anthem health plans include coverage for doctor visits, hospital care, and mental health benefits, plus: $0 virtual care, 24/7 † $0 preventive care. Are you new to Blue Cross and Blue Shield of Texas (BCBSTX)? Here are some questions to ask when picking the best health plan benefits for you and your family. Which plan is right for you? · Blue Advantage · Blue Value · Blue Local with Atrium Health · Blue Home with Novant Health · Blue Home with UNC Health Alliance. We offer affordable health, dental, and vision coverage to fit your budget. Plus, you may qualify for financial help to lower your health coverage costs. Our individual & family health plans in California are designed to be affordable for different needs and budgets. With a variety of coverage options. Deductible Plan - pay period Co Insurance in network - 80% Out of Network - 60% Estimated out of pocket cost - FSA tax. better benefits to meet the needs of your whole family. Have a health Independent licensees of the Blue Cross and Blue Shield Association. Sydney. Blue Shield of CA offers both employer and individual & family HMO and PPO health insurance plans for every budget, as well as dental and vision coverage. Official Site of Anthem Blue Cross Blue Shield, a trusted health insurance plan provider. Shop plans for Medicare, Medical, Dental, Vision & Employers. We are a team of caring individuals who invest our best ideas and efforts to help create innovative health coverage solutions that are accessible to all. Administered by Anthem Blue Cross (medical) and Navitus (pharmacy); supported by Accolade Health Care Advocate CORE is a high-deductible PPO plan that is. Independent licensees of the Blue Cross and Blue Shield Association. Sydney Care is offered through an arrangement with Carelon Digital Platforms, Inc. You have chosen Anthem Blue Cross of California. While we strive to keep this list up to date, it's always best to check with your health plan.

Jatix Stock Price

JATIX Janus Henderson Global Technology and Innovation Fund Inst. Charting. Follow. $ (+%)08/14/ Mutual Fund | $USD | NAV. It is run by Jatix, who is located just south of Sanfew's house in Taverley. Stock Edit. Item, Number in stock, Price Jatix's Herblore Shop Jatix's Herblore. JATIX - Janus Henderson Glb Tech and Innovt I - Review the JATIX stock price, growth, performance, sustainability and more to help you make the best. JATIX Global Technology and Innovation Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Quicken's Money Guide now brings you more than just the latest stock price. JATIX, Janus Henderson Global Technology and Innovation Fund Class I, NASDAQ. stock's price. This type of risk can be diversified away by owning several different stocks in different industries whose stock prices have shown a small. View the latest Janus Henderson Global Technology and Innovation Fund;I (JATIX) stock price, news, historical charts, analyst ratings and financial information. Analyze the Fund Janus Henderson Global Technology and Innovation Fund Class I having Symbol JATIX for type mutual-funds and perform research on other. Small Growth, ; Small Value, ; Foreign Stock, ; Emerging Market, ; Precious Metal, JATIX Janus Henderson Global Technology and Innovation Fund Inst. Charting. Follow. $ (+%)08/14/ Mutual Fund | $USD | NAV. It is run by Jatix, who is located just south of Sanfew's house in Taverley. Stock Edit. Item, Number in stock, Price Jatix's Herblore Shop Jatix's Herblore. JATIX - Janus Henderson Glb Tech and Innovt I - Review the JATIX stock price, growth, performance, sustainability and more to help you make the best. JATIX Global Technology and Innovation Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Quicken's Money Guide now brings you more than just the latest stock price. JATIX, Janus Henderson Global Technology and Innovation Fund Class I, NASDAQ. stock's price. This type of risk can be diversified away by owning several different stocks in different industries whose stock prices have shown a small. View the latest Janus Henderson Global Technology and Innovation Fund;I (JATIX) stock price, news, historical charts, analyst ratings and financial information. Analyze the Fund Janus Henderson Global Technology and Innovation Fund Class I having Symbol JATIX for type mutual-funds and perform research on other. Small Growth, ; Small Value, ; Foreign Stock, ; Emerging Market, ; Precious Metal,

A high-level overview of Janus Henderson Global Technology and Innovation Fund Inst (JATIX) stock. Stay up to date on the latest stock price, chart, news. JATIX Quick Quote JATIX, , 7/6/, , , , Janus Global Certain Zacks Rank stocks for which no month-end price was available, pricing. Real time Janus Investment Fund - Janus Henderson Triton Fund (JATTX) stock price quote, stock graph, news & analysis. JATIX. JATNX. N/A. JATSX. JAGTX. Janus Henderson International Opportunities price of an individual stock, as opposed to securities prices generally. In. Janus Henderson Global Technology and Innovation Fund (JATIX) ; Aug 1, , , , , ; Jul 31, , , , , TICKER-SYMBOL>JAGCX C Class I SYMBOL>JATIX. stock price has recovered. High Yield. Yields over 4% ››. Stocks, ETFs, Funds (JATIX). JAGTX (Mutual Fund). Janus Henderson Global Technology and. US stock, %, %, %. Non-US stock, %, %, %. Cash, %, Pricing for ETFs is the latest price and not "real time". Share price. stock price has recovered. High Yield. Yields over 4% ››. Stocks, ETFs, Funds (JATIX). JNGTX (Mutual Fund). Janus Henderson Global Technology and. Get powerful stock screeners & detailed portfolio analysis. Subscribe NowSee Plans & Pricing · ios android. TipRanks is a comprehensive research tool. Janus Henderson Global Technology and Innovation (JATIX). (%) 09/03/24 [FUND]. underlying price (). Snapshot Chart for Tue, Sep 3rd, MASTERCARD INC, , View More JATIX Holdings. Stock Holding Certain Zacks Rank stocks for which no month-end price was available, pricing. Janus Henderson Global Technology and Innovation Fund Inst (JATIX) chart price and fundamental data. Compare data across different stocks & funds. $ I, JATIX, Janus Henderson Global Technology and Innovation Fund I price and activity for your symbols on the My Quotes of cazinobitcoin.site Continue. Get the latest Janus Henderson Global Technology and Innovation Fund Class T (JAGTX) stock price quote with financials, statistics, dividends. Get the latest Janus Henderson Global Technology and Innovation Fund Class I (JATIX) price, news, buy or sell recommendation, and investing advice from Wall. JATIX, Class I Shares, JAGTX, Class T Shares. Summary Prospectus dated investing in the Fund with the cost of investing in other mutual funds. The. Compare to other instruments Search for stocks, ETFs, and funds for a quick comparison or use the comparison tool for more options. Symbol name. The Growth Fund of America Class A Shares. $ + +%. TRBCX. T. Rowe Price Blue Chip Growth Fund, Inc. $ + +%. NPlus Promo Banner_v2. See holdings data for Janus Henderson Glb Tech and Innovt Fd (JATIX) Rowe Price Science And Technology Fd PRSCX. %. Wireless Fund WIREX.

How To Get Started In Commercial Real Estate Investing

Commercial real estate (CRE) is an appealing investment class because of its consistent returns, passive income, and growth potential. Commercial real estate offers diverse property types and investment opportunities. Its advantages include higher earning potential, reduced competition, long-. Begin by understanding the different types of commercial properties, market trends, and industry terminology. Reading books, attending seminars, and following. Income potential. The best reason to invest in commercial over residential rentals is the earning potential. Commercial properties typically have an annual. Begin by understanding the different types of commercial properties, market trends, and industry terminology. Reading books, attending seminars, and following. Real Estate Investment Trusts: A REIT is a publicly traded company that owns and manages income-generating real estate assets. Investors can buy shares in the. By meeting local commercial property investors, you will have a better chance. Networking is quite a reliable way for commercial investment. By joining the. Unlike fix-and-flip residential properties, commercial real estate investing is a long game. Most projects have a 2+ year anticipated hold period—some even. 1. Buying a commercial property yourself. Investors can make commercial property investments directly, however, it can be expensive and requires an investor to. Commercial real estate (CRE) is an appealing investment class because of its consistent returns, passive income, and growth potential. Commercial real estate offers diverse property types and investment opportunities. Its advantages include higher earning potential, reduced competition, long-. Begin by understanding the different types of commercial properties, market trends, and industry terminology. Reading books, attending seminars, and following. Income potential. The best reason to invest in commercial over residential rentals is the earning potential. Commercial properties typically have an annual. Begin by understanding the different types of commercial properties, market trends, and industry terminology. Reading books, attending seminars, and following. Real Estate Investment Trusts: A REIT is a publicly traded company that owns and manages income-generating real estate assets. Investors can buy shares in the. By meeting local commercial property investors, you will have a better chance. Networking is quite a reliable way for commercial investment. By joining the. Unlike fix-and-flip residential properties, commercial real estate investing is a long game. Most projects have a 2+ year anticipated hold period—some even. 1. Buying a commercial property yourself. Investors can make commercial property investments directly, however, it can be expensive and requires an investor to.

Under the fund structure, investors contribute capital for the general purpose of investing in commercial real estate. Each fund specifies what type of. Tools not required to get started in commercial investing You don't need to have started in residential real estate investing first to go into commercial. How to Get Started in Commercial Real Estate Investing · Decide if Investing in a Commercial Property is the Correct Plan for You · Recognize the Function of. The CCIM Institute meets the emerging needs of commercial real estate professionals, delivering its education, technology, and network to advance the. 1. Get educated and certified · Certified Commercial Investment Member Institute (CCIM) · MIT's Center for Real Estate · Urban Land Institute (ULI) · Certified. How To Invest In Commercial Real Estate: Getting Started · 1. Understand How Commercial Real Estate Is Different · 2. Analyze Comparables · 3. Use The Right. I am new to this space and would love to get pointers on how to get started, how to find RE agents, any gotchas or considerations for new investors. Understanding Commercial Real Estate Investing · How to Make Informed Decisions · Vacancy Rates Across Different Asset Types · Operating Expenses Relative to Lease. Contemplate your involvement: Are you just a passive investor, providing the equity needed to purchase a property, or are you planning to be more involved? If. Some commercial property loans can be fully paid off in as little as ten years: after which time that passive income will go straight into your pocket. The. 1. Commercial property real estate ETFs · 2. Commercial property real estate mutual funds · 3. Commercial property REITs · 4. Commercial property real estate. Book overview · Get leads on commercial property investments · Determine what a property is worth · Find the right financing for you · Handle inspections and fix. If you see tremendous opportunities in the commercial real estate world, Saint Investment Group is here to help you get into the game. Understand commercial real estate to invest in their own deals - Many would-be investors want to get into commercial real estate, but they just don't know where. Commercial real estate investing is very capital-intensive. In a best-case scenario, a lender will want the owner to put down 20 percent in equity before. Securing financing is a crucial step in entering the world of commercial real estate. Various financing options are available, from traditional bank loans to. Find, Fund, and Close Your First Commercial Real Estate Deal - Even If You're Starting From Scratch A self-guided, online course that teaches real-world. Tips and Tricks for Success When Choosing Commercial Real Estate for Sale · Build a Strong Network · Never Skip the Due Diligence · Location, Location, Location. Learn everything you need to know to assess the benefits of a commercial real estate investment and make the best decisions to get started. How to get started in commercial real estate investing, even if you've never tried it before · How to work with business and investment partners and protect your.

Cash App 2500 Limit

If you go through a verification process, your account can be upgraded to a send limit of $ per week and an unlimited receiving limit. Cash App allows users to send and receive money. However, the Cash App daily and weekly withdrawal limits may restrict what you withdraw money from your. Cash App imposes limits on the amount of money you can send and receive. For unverified accounts, the sending limit is up to $ per week, and. How to increase the Cash App limit from to $? Search. Search This Labels. cash app add cash limit $ · cash app atm withdrawal limit · cash. 2, in government rebates ⁎. Starting at ⁎. $. 59, Includes a total EXCLUSIVE CUSTOMER LOYALTY CASH. For a limited time, eligible customers get. M posts. Discover videos related to Cash App Limit on TikTok. See more videos about Whats A Cash App Limit, Cash App Method , Cash Counting App. So the back account linked to cash app has to have a daily withdrawal limit high enough to get the $/ week spend limit. That's the main. Debit card limits aren't uncommon—especially on mobile money transfer apps. But Cash App and Cash Card's limits are particularly low: Cash App: You can send up. There is a day limit of $1, for sending and receiving funds for unverified accounts. How do I increase my Cash App limit from $2, to $7,? To. If you go through a verification process, your account can be upgraded to a send limit of $ per week and an unlimited receiving limit. Cash App allows users to send and receive money. However, the Cash App daily and weekly withdrawal limits may restrict what you withdraw money from your. Cash App imposes limits on the amount of money you can send and receive. For unverified accounts, the sending limit is up to $ per week, and. How to increase the Cash App limit from to $? Search. Search This Labels. cash app add cash limit $ · cash app atm withdrawal limit · cash. 2, in government rebates ⁎. Starting at ⁎. $. 59, Includes a total EXCLUSIVE CUSTOMER LOYALTY CASH. For a limited time, eligible customers get. M posts. Discover videos related to Cash App Limit on TikTok. See more videos about Whats A Cash App Limit, Cash App Method , Cash Counting App. So the back account linked to cash app has to have a daily withdrawal limit high enough to get the $/ week spend limit. That's the main. Debit card limits aren't uncommon—especially on mobile money transfer apps. But Cash App and Cash Card's limits are particularly low: Cash App: You can send up. There is a day limit of $1, for sending and receiving funds for unverified accounts. How do I increase my Cash App limit from $2, to $7,? To.

Cash App customers may be able to claim more than $2, each as part of a $15 million class-action settlement for data and security breaches at the mobile. Cash App Sending Limits: The default sending limit is $2, per week. · Cash App Receiving Limits: Initially, the Cash App allows users to. In addition to describing the cash limit, this article will also cover when the limit resets and how to increase your Cash App limit from $ to $ Earn 3% and 2% cash back on the first $2, in combined purchases each quarter in the choice category, and at grocery stores and wholesale clubs, then earn. Quickly find all the support documentation in your Cash App settings. Update your settings in-app or online. How to increase the Cash App limit from to $? Search. Search This Labels. cash app add cash limit $ · cash app atm withdrawal limit · cash. Increasing your Cash App limit from $2, to $7, is achievable through identity verification, linking a bank account, regular usage, and responsible. Cash App allows you to withdraw up to $2, per day and $7, per week if you verify your identity. Call +1()– Without. Interac e-Transfers note. Sending: $5, per transfer, per hour period. Receiving: $25, per transfer · Desjardins money transfers (on AccèsD or at ATMs). How Much Money Can You Send on Cash App in One Day? For verified users, Cash App spending limit to $2, per week, which provides significantly more. You can use your Cash App Card to get cash back at checkout and withdraw cash from ATMs, up to the following limits: $1, per day; $1, per ATM. The Cash App limit per day and per transaction for Cash Card users is $7, How do I increase my Cash App limit from $2, to $7,? To increase your. Cash App offers standard transfers to your bank account and Instant transfers to your linked debit card. Standard transfers are free and arrive within PayPal allows for one-time payments of up to $ without an account and up to $ with a verified account, with potential transaction limits of $ Google Pay has limits for storing and transferring money. Total balance limit Daily maximum total transaction amount: $2, USD. Up to 15 transactions. A basic Cash App account has a weekly $ sending limit and a monthly $1, receiving limit. If you go through a verification process, your account can be. How to Increase Cash App Limit from $2, to $7, · Enjoy the full SoundCloud experience in the app. In addition to describing the cash limit, this article will also cover when the limit resets and how to increase your Cash App limit from $ to $ The Cash App imposes daily and weekly sending limits on user accounts. As an unverified user, your sending limit is typically lower than. How to increase cash app limit from to $7,? · 1. Verify Your Account. Verification increases your transaction limits significantly. · 2. Link a Bank.

Collateral Assignee Life Insurance

This is a form of collateral assignment of a life insurance policy where a borrower or guarantor (the assignor) as owner of a life insurance policy assigns. You can assign your policy to a financial institution as additional security for a loan. The policy can be reassigned to you as the Policyowner once the loan is. Collateral assignment of life insurance involves using a policy as collateral when getting a loan. Learn how collateral assignment of life insurance works. ASSIGNMENT OF LIFE INSURANCE POLICY AS COLLATERAL*. Notice: Should you have any question as to the legal effect of any provisions of this document. A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to. Yes, life insurance can be used as collateral for a loan. The policy's cash value or death benefit can be pledged to secure the loan, with the lender having a. A collateral assignment of insurance is a conditional assignment appointing a lender as the primary beneficiary of a benefit to use as collateral for a loan. If. This assignment is made and the Policy is to be held as collateral security for any and all liabilities of one or more of the undersigned to the Assignee. A collateral assignment pledges a permanent life insurance policy's cash value and death benefits to another party and is most commonly used to secure a loan. This is a form of collateral assignment of a life insurance policy where a borrower or guarantor (the assignor) as owner of a life insurance policy assigns. You can assign your policy to a financial institution as additional security for a loan. The policy can be reassigned to you as the Policyowner once the loan is. Collateral assignment of life insurance involves using a policy as collateral when getting a loan. Learn how collateral assignment of life insurance works. ASSIGNMENT OF LIFE INSURANCE POLICY AS COLLATERAL*. Notice: Should you have any question as to the legal effect of any provisions of this document. A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to. Yes, life insurance can be used as collateral for a loan. The policy's cash value or death benefit can be pledged to secure the loan, with the lender having a. A collateral assignment of insurance is a conditional assignment appointing a lender as the primary beneficiary of a benefit to use as collateral for a loan. If. This assignment is made and the Policy is to be held as collateral security for any and all liabilities of one or more of the undersigned to the Assignee. A collateral assignment pledges a permanent life insurance policy's cash value and death benefits to another party and is most commonly used to secure a loan.

To clarify, a collateral assignment allows the life insurance company to pay your SBA lender only what they are owed and the rest goes to your beneficiary. As. 1. “Company” as referred to herein, is Massachusetts Mutual Life. Insurance Company, and/or MML Bay State Life Insurance Com- pany. The sole right to collect from Zurich American Life Insurance Company ("Insurer") the net proceeds of the. Policy due to the death of the insured or maturity;. A. For Value Received the undersigned hereby assign, transfer and set over to of its successors and assigns, (herein called the “Assignee”) Policy No. A collateral assignment is a legal arrangement where the policyholder assigns the benefits of their policy to a lender as collateral for a loan. Learn more! Collateral assignment of life insurance leverages your life insurance as loan collateral. Find out how it works and what's required. Similar to an assignment, certain rights in a life insurance policy can be assigned to a third party, typically as security for a loan or other business. This assignment is made and the Policy is to be held as collateral security for any and all liabilities of the undersigned, or any of them, to the Assignee. Follow the screen prompts. You can also mail to: USAA Life Insurance Company. USAA Life Insurance Company of New York. Fredericksburg Road. How Does It Work? When you assign your life insurance policy as collateral, you continue to own the policy and pay the premiums. However, the lender gains the. ASSIGNMENT OF LIFE INSURANCE POLICY AS COLLATERAL*. Notice: Should you have any question as to the legal effect of any provisions of this document. It includes a form of assignment of life insurance policy as collateral. Lenders may take a life insurance policy as collateral for a loan. The life insurance. This is an irrevocable assignment of life insurance coverage. For example, you should not make an assignment as collateral for a bank loan which you intend to. By signing the assignee understands the provisions of this policy/contract being accepted as collateral. Creditor Information and Signature of Authorized. This is a form of collateral assignment of a life insurance policy where a borrower or guarantor (the assignor) as owner of a life insurance policy assigns. Assignment of Life Insurance Policy or Annuity Contract as Collateral Security. General Information – Required. Policy / Contract No.: Insured Name (Life. The insurance company hereby acknowledges that by recording this Irrevocable Collateral Assignment of Life Insurance Proceeds, it agrees to accept and abide by. ivari is not responsible for the validity of the assignment. The assignment takes effect when it is recorded by ivari. 1 Contract Details. Policy Number(s). This assignment is made and the Policy is to be held as collateral security for any and all liabilities of the undersigned, or any of them, to the. Assignee. If the policy is transferred as a means of establishing security on a debt, it is considered a collateral assignment. If the insured dies before the debt is.

Quicken Loans Vs Lending Tree

LendingTree is not a mortgage provider, nor is it a broker. Like a broker, the company connects consumers with multiple banks and loan companies. loan operators for loans, credit cards and insurance products. LendingTree's primary competitors include SoFi, LendingClub, Quicken Loans and 10 more. While both provide online applications, one is a better pick for those who want to compare their mortgage options. lenders, including Wells Fargo, Prosper Marketplace, Lending Club, Quicken Loans, Discover, and more. To date, we've facilitated more than 35M loan requests. Like our comparison between Rocket Mortgage and Quicken Loans above, this is a case of two different lending business models. Rocket Mortgage is a direct-to-. and its leadership team. Competitive Landscape Given LendingTree's presence alongside companies like LendingClub, Quicken Loans, and SoFi, understanding the. One of the major differences between Quicken Loans and LendingTree is how they operate. Lending Tree acts as a broker, working with lenders directly to find. Lending Act Certificate of Registration #RM, Louden St. #2, Cincinnati, OH ; OK Mortgage Broker License #MB; OK Credit Services. Quicken is a mortgage banker and, to the best of my knowledge, they are an honest company. Lending Tree is not a lender. LendingTree is not a mortgage provider, nor is it a broker. Like a broker, the company connects consumers with multiple banks and loan companies. loan operators for loans, credit cards and insurance products. LendingTree's primary competitors include SoFi, LendingClub, Quicken Loans and 10 more. While both provide online applications, one is a better pick for those who want to compare their mortgage options. lenders, including Wells Fargo, Prosper Marketplace, Lending Club, Quicken Loans, Discover, and more. To date, we've facilitated more than 35M loan requests. Like our comparison between Rocket Mortgage and Quicken Loans above, this is a case of two different lending business models. Rocket Mortgage is a direct-to-. and its leadership team. Competitive Landscape Given LendingTree's presence alongside companies like LendingClub, Quicken Loans, and SoFi, understanding the. One of the major differences between Quicken Loans and LendingTree is how they operate. Lending Tree acts as a broker, working with lenders directly to find. Lending Act Certificate of Registration #RM, Louden St. #2, Cincinnati, OH ; OK Mortgage Broker License #MB; OK Credit Services. Quicken is a mortgage banker and, to the best of my knowledge, they are an honest company. Lending Tree is not a lender.

Lending Tree. By reducing the term of your loan, you'll take advantage of Quicken Classic For Mac · Quicken Classic Starter · Quicken Classic Bill Manager. You can get conventional loans, FHA loans, VA loans and USDA loans for loan amounts less than $, Rocket Mortgage, No set minimum. Small mortgage. Like our comparison between Rocket Mortgage and Quicken Loans above, this is a case of two different lending business models. Rocket Mortgage is a direct-to-. loan operators for loans, credit cards and insurance products. LendingTree's primary competitors include SoFi, LendingClub, Quicken Loans and 10 more. Rocket Mortgage and Quicken Loans are the exact same thing. They operate under both names. They have good service, and excellent tools, but their default rates. Unlike LendingTree, who simply sells your information to multiple companyies,Quicken Loans, a single mortgage lender, can only offer you their interest rates. We googled "best mortgages refi" and lending Tree returned with top 4 companies. Rocket Mortgage Mortgage was one of them. We received a phone call and. Rocket Mortgage is an online direct-lending platform for residential mortgages and home loan products. · Rocket Mortgage was formerly known as Quicken Loans, but. compare home loan options and apply online. Company: Quicken Loans, LLC. Industry: Finance > Banking Credit and Lending. Global Rank. #73, Country Rank. If you take the time to shop around and find the right refinance mortgage lender Lending Tree. By reducing the term of your loan, you'll take advantage. Rocket Loans can be a great option for borrowers with decent credit who want flexible loan amounts and a fast application process. Rocket Mortgage, part of the online powerhouse lender Quicken Loans, wins our top spot as the best online mortgage lender. Rocket Mortgage vs. United Wholesale Mortgage Like our comparison between Rocket Mortgage and Quicken Loans above, this is a case of two different lending. Learn how the Rocket Mortgage process works and get approved online to buy a home or refinance your mortgage. Rocket Mortgage, LLC, Rocket Homes Real Estate LLC, and RockLoans Marketplace LLC (doing business as Rocket Loans®) are separate operating subsidiaries of. LendingClub: Best for peer-to-peer lending. LendingClub logo. (7, The company is part of Quicken Loans and is the sister company to Rocket Mortgage. Loan types and availability. Rocket Mortgage originates mortgages across the U.S. (though not in Puerto Rico) and is available to customers who are buying or. A variety of mortgage products and loans are available in today's market. Learn more about the pros and cons of different loan types. online. Company: Quicken Loans, LLC. Industry: Finance > Banking Credit and Lending. Global Rank. #73, Country Rank. #15, 1, United States. Let's look at three ways that Quicken Loans uses technology and marketing to grow their business. Google Your Brand The stat we all know is that around 74% of.