cazinobitcoin.site

Learn

Low Cost Extended Car Warranty

The best alternative to a car warranty is to fund the cost yourself. If you put the money you'd spend on monthly premiums in a high-yield savings account, you'. These contracts protect vehicle owners from high repair costs. Extended Auto warranties cover sudden Vehicle breakdowns and Mechanical failures. These are not. What Is The Cheapest Extended Warranty for Cars? · Transmission Rebuild or Replacement. Average Cost: $1,$3, · Airbag Replacement. Average Cost: $3,$. Mopar for 6 years total doesn't seem to be significantly less cost than CNA does for 9. Best Extended Car Warranty · Best Extended Warranty. In essence, buying an extended warranty is making a bet that the repair costs of the vehicle between the expiration of the included warranty and the expiration. Coverage. Affordable Safety Net. Extended Car Warranty Benefits. Peach State's Extended Vehicle Service Contract through Warrantech puts the brakes on. Don't wait until your current warranty ends, when prices go up. Get the best price and coverage while your car is still low on age and miles. Get a free quote. We do this by providing affordable, accessible extended mechanical coverage for all vehicle types. Simply pick a plan that suits you, select a manageable. Extended car warranties may not be worth it due to other more affordable and comprehensive coverage options available. For instance, a pay-as-you-go vehicle. The best alternative to a car warranty is to fund the cost yourself. If you put the money you'd spend on monthly premiums in a high-yield savings account, you'. These contracts protect vehicle owners from high repair costs. Extended Auto warranties cover sudden Vehicle breakdowns and Mechanical failures. These are not. What Is The Cheapest Extended Warranty for Cars? · Transmission Rebuild or Replacement. Average Cost: $1,$3, · Airbag Replacement. Average Cost: $3,$. Mopar for 6 years total doesn't seem to be significantly less cost than CNA does for 9. Best Extended Car Warranty · Best Extended Warranty. In essence, buying an extended warranty is making a bet that the repair costs of the vehicle between the expiration of the included warranty and the expiration. Coverage. Affordable Safety Net. Extended Car Warranty Benefits. Peach State's Extended Vehicle Service Contract through Warrantech puts the brakes on. Don't wait until your current warranty ends, when prices go up. Get the best price and coverage while your car is still low on age and miles. Get a free quote. We do this by providing affordable, accessible extended mechanical coverage for all vehicle types. Simply pick a plan that suits you, select a manageable. Extended car warranties may not be worth it due to other more affordable and comprehensive coverage options available. For instance, a pay-as-you-go vehicle.

It usually has deductibles that can be significantly higher than an extended warranty. However, its cost is typically much lower than the cost of a used car. Extended Vehicle Care helps pay for costly repairs after your manufacturer's warranty expires. They are usually offered by auto dealerships or third parties—and instead of warranting a product or extending the time on an original manufacturer's warranty. That's around $80 per month for 36 months. Without warranty, these items will cost way more than $ to repair/replace: engine, transmission, infotainment. The average annual cost of an extended vehicle warranty ranges from $1, to $3, a year, depending on several factors, including the type of warranty, the. Many people buy a Vehicle Service Contract (“VSC”) or similar agreement to cover the cost of future repairs. This guide provides information on buying and using. For example, CU SoCal offers the healthCAR Warranty, a low cost, month-to-month auto warranty coverage that helps car owners avoid costly repairs. There is. It usually has deductibles that can be significantly higher than an extended warranty. However, its cost is typically much lower than the cost of a used car. An extended auto warranty protects you from costs associated with a mechanical breakdown. It covers unforeseen repairs on various systems and components. Low-cost extended warranty protection powered by Route 66 provides comprehensive mechanical breakdown coverage for many makes and models of vehicles. With an extended warranty, you can save thousands on repairs by purchasing an affordable coverage plan and paying only a small deductible (as low as $0 for some. Extended warranties are great for people who want to be prepared for possible repairs that may be needed once the factory warranty expires. Infinite Auto Protect provides affordable pricing options for buyers, flexible payment methods, and a price match guarantee to cut costs compared to what. You can always take time to review the terms of an extended warranty and buy it after you've purchased the car. Just like the car the warranty is for, the price. Freedom Warranty offers Extended Vehicle Service Contract Protection economy, luxury, and classic cars, regardless of make or model. However, the costs of the premiums can range from $1, to $2, and can cost even more if you select a comprehensive plan that lasts for several years. Comprehensive Coverage. Protection for a wide range of vehicle components. · Affordable Pricing. Flexible payment options to fit your budget. · Nationwide Network. Vehicle warranty options provided by IWS Group · Affordable protection for new and many pre-owned vehicles · Warranties offer nationwide protection with low. Extended warranties are great for people who want to be prepared for possible repairs that may be needed once the factory warranty expires. According to the most recent survey on the subject by Consumer Reports, more than half of car owners with extended warranty plans paid more for their coverage.

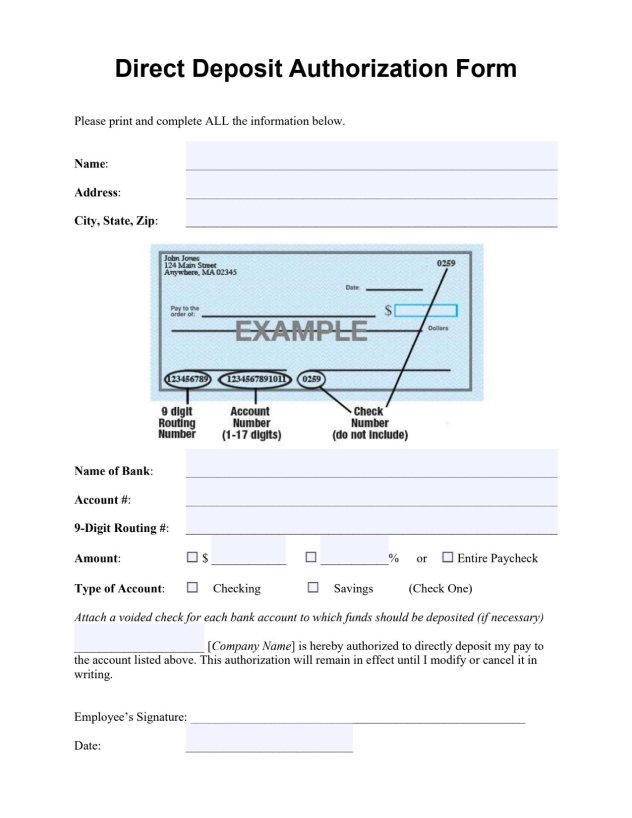

Can I Get Direct Deposit Form Online

To have your paycheck deposited directly into your checking or savings account, download, print and complete the direct deposit authorization form. Online Direct Deposit Tools. Find the information needed by your employer on the new Direct Deposit page in Online Banking. Set Up Direct Deposit. How. Check with your employer's payroll office. You may be able to complete setup through an online portal. If not: Complete a direct deposit form. Provide the form. If you receive federal benefits, you can find a federal direct deposit form on the U.S. Department of the Treasury website. Additional resources. How else can. If you receive regular payments, such as a paycheck or Social Security benefits, you can have the funds deposited directly into your account. This is known as. does this automatically. The employer will have two choices. Do-It-Yourself Payroll – Use a Free Online Calculator while using IRS Publication 15 (scroll to. Include your routing and account number on the form. These can be found on the bottom of your checks, through Online Banking (on your Account Overview) or at a. Yes, PayPal Direct Deposit is used for payroll and direct deposits from government agencies. A PayPal Balance account with no limitations is required. If PayPal. You can get it from either. Your employer just needs the routing and account number at the bottom of the check plus your name on the account. To have your paycheck deposited directly into your checking or savings account, download, print and complete the direct deposit authorization form. Online Direct Deposit Tools. Find the information needed by your employer on the new Direct Deposit page in Online Banking. Set Up Direct Deposit. How. Check with your employer's payroll office. You may be able to complete setup through an online portal. If not: Complete a direct deposit form. Provide the form. If you receive federal benefits, you can find a federal direct deposit form on the U.S. Department of the Treasury website. Additional resources. How else can. If you receive regular payments, such as a paycheck or Social Security benefits, you can have the funds deposited directly into your account. This is known as. does this automatically. The employer will have two choices. Do-It-Yourself Payroll – Use a Free Online Calculator while using IRS Publication 15 (scroll to. Include your routing and account number on the form. These can be found on the bottom of your checks, through Online Banking (on your Account Overview) or at a. Yes, PayPal Direct Deposit is used for payroll and direct deposits from government agencies. A PayPal Balance account with no limitations is required. If PayPal. You can get it from either. Your employer just needs the routing and account number at the bottom of the check plus your name on the account.

You can even use this form to have dividend or insurance payments directly deposited to your account. No more wondering if the check will get to you on time. Online Direct Deposit Enrollment Service is available for IHSS and WPCS providers on the IHSS Electronic Services Portal (ESP) website. The Online Direct. Receiving paychecks quickly, automatically and digitally is important to employees. Employers need to ensure they have that option available for new hires. If you live in the United States and certain U.S. Territories, you can enroll in direct deposit through myPay. If you don't have a myPay account yet, you can. Use our pre-filled form You can also download a blank Direct Deposit/Automatic Payments Set-up Guide (PDF) and fill in the information yourself. How to get it To sign up for direct deposit, complete the form you receive from your employer or other payer with the following information: Or, you may. Quick – It's easy to receive your benefit by Direct Deposit. You can sign up online at Go Direct®, by calling , in person at your bank, savings. This option is not available for business accounts. · If you're unable to set up direct deposit digitally or obtain a prefilled form, you can download a blank. Submit your forms to your employer's HR or payroll department. Fill out a Payroll Direct Deposit form and submit to your payroll department. · Do you. With our automated setup, enrolling in direct deposit is as easy as Skip the tedious payroll forms and set up direct deposit yourself. All you need is. A lot of banks and financial institutions offer a pre-filled form through online banking, which makes it super easy to set up direct deposit. · The second step. Step one After signing in, tap the account where you want to receive your direct deposit · Step two Swipe up and tap "Set up direct deposit form" · Step three. TD Bank makes setting up direct deposit easy with this convenient, pre-filled form. There are two types of direct deposit enrollment available: Federal. A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account. Employers usually provide a direct deposit authorization form upon request. Some employers may even provide one as part of your onboarding paperwork. You can. You can email yourself a direct deposit form directly from your Found app by following these steps: Select your name or business logo in the top-right corner of. Discover some simple steps to help you access a pre-filled direct deposit form using EasyWeb Online banking. To get started, log in to EasyWeb. If you don't. You can quickly sign up and submit your direct deposit application by logging into Your Online Account. Over the Phone. You can contact the Texas State. How Can I Set Up Direct Deposit? · Sign in to your online banking account using a web browser. · Select the Checking account you'd like to enroll in direct. Check with your employer to see if they have a custom direct deposit form for you to complete. You will need to enter the following information: Your name. Your.

Can You Invest In Real Estate With 10k

Many people are looking for ways to invest their money and one option is to use 10k dollars as a down payment on a rental property. This can be a great. But over the years it kind of gave me my first look at what passive real estate investing can do for you in terms of cashflow. 10k monthly cashflow. However, with the right guidance and knowledge, you can start investing in Indian real estate with just INR 10, Problem Statement: Many. investment solutions across the credit, real estate, private equity and infrastructure asset classes. We collaborate to consistently deliver innovative. Yes, you definitely can. You can get started with as little as $1, I once spent $ to mail about 16, postcards to my county for. Mutual Funds & Exchange-Traded Funds (ETF) · Real Estate Crowdfunding · Real Estate Investment Trusts (REIT) · Rehabbing & Home Improvements · High-Yield Savings. Considering the best way to invest $10k, rental properties offer flexibility: you could potentially withdraw your investment from one property and reinvest it. As far as investing though, single-family homes, income property, that is without a doubt the most historically proven asset class in the entire world, and also. Key Takeaways. Flipping is a real estate strategy that involves buying homes, renovating them, and selling them for a profit in a short period of time. Many people are looking for ways to invest their money and one option is to use 10k dollars as a down payment on a rental property. This can be a great. But over the years it kind of gave me my first look at what passive real estate investing can do for you in terms of cashflow. 10k monthly cashflow. However, with the right guidance and knowledge, you can start investing in Indian real estate with just INR 10, Problem Statement: Many. investment solutions across the credit, real estate, private equity and infrastructure asset classes. We collaborate to consistently deliver innovative. Yes, you definitely can. You can get started with as little as $1, I once spent $ to mail about 16, postcards to my county for. Mutual Funds & Exchange-Traded Funds (ETF) · Real Estate Crowdfunding · Real Estate Investment Trusts (REIT) · Rehabbing & Home Improvements · High-Yield Savings. Considering the best way to invest $10k, rental properties offer flexibility: you could potentially withdraw your investment from one property and reinvest it. As far as investing though, single-family homes, income property, that is without a doubt the most historically proven asset class in the entire world, and also. Key Takeaways. Flipping is a real estate strategy that involves buying homes, renovating them, and selling them for a profit in a short period of time.

BREIT gives individuals the ability to invest with the world's largest commercial real estate owner through a perpetually offered, non-listed REIT. AMH is a leading large-scale integrated owner, operator and developer of single-family rental homes. We're an internally managed Maryland real estate. If you get an average of $ per door per month in cashflow from a rental property, investing in a duplex will only net you $2, a year. Three of these net. I'd say it depends what your goal is. If you're planning on investing in RIETs, then yes, you can definitely toss $10k into there. Investing with $10, is certainly something you can do with tax defaulted property investing. At tax defaulted property auctions, you can get real estate for. Investing with $10, is certainly something you can do with tax defaulted property investing. At tax defaulted property auctions, you can get real estate for. investment solutions across the credit, real estate, private equity and infrastructure asset classes. We collaborate to consistently deliver innovative. Mutual funds; Exchange-traded funds; CDs; Real estate investment trusts; Money market accounts; Roth IRAs; High-yield savings accounts; Brokerage accounts. Beyond that, if you have more to spend, you could think about investing in a real estate-centric ETF (exchange traded fund) or buying an apartment or house. And. Then also don't wait for the money to grow and to be available for a deposit for a real estate investment. This is advice you will hear a lot on many forums. Can you flip houses with minimal funds? Ever pondered that possibility? Well, flipping or flip a house with $10k isn't just wishful thinking; it's entirely. I recently shared a post on Instagram explaining 4 ways you can invest in Real Estate with less than $10k and asked which you wanted to learn more about. $10k a month in real estate with no money down, no credit check, and no real estate license? Sounds too good to be true right!? But it's not! These allow everyday investors to pool their money to purchase property (or a share of property) as a group. If you don't want to make investment decisions on. You can do this by investing in stocks, real estate, dividends, etc. The key word here being “investing” — investing means spending money now for a better. Key Takeaways. Flipping is a real estate strategy that involves buying homes, renovating them, and selling them for a profit in a short period of time. With as little as $, you can invest in the Australian property market through pooled mortgage funds. Investment strategy · Buy-and-hold. This strategy relies on buying a property and holding it for a long period of time so you can profit from its appreciation. Investment Risks: An investment in shares of common stock of JPMREIT involves a high degree of risk. These securities should only be purchased if you can afford. It is not possible to live from $10k alone, but investing $10k can produce high-yield results, depending on the vehicle used. While 10k may not get you out of 6.

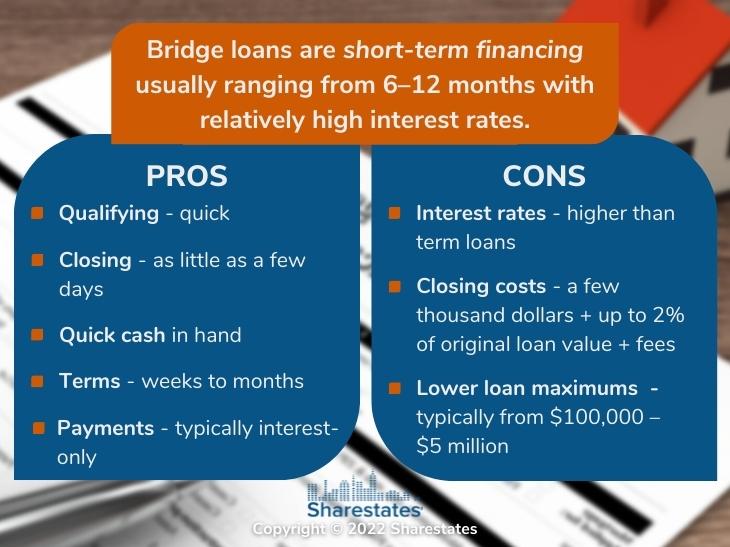

What Does Bridge Financing Mean

Bridge financing, also called a bridge loan, is a way to help bridge the gap between closing on your current house and your new place. Bridge loans are intended to fill a gap until long-term financing can be obtained. However, there is significant risk associated with the short-term funding. Bridge financing (often called a bridge loan) is a short-term financial solution designed to bridge the gap between immediate funding needs and long-term. In the broadest definition, the term bridge loan is commonly referred to as: A short-term loan providing temporary financing until permanent financing can be. According to the bridge loan business definition, this type of financing is defined by its use as funding for immediate purchases. Commercial bridge loans can “. In the context of real estate, a bridge loan, sometimes referred to as hard money, private lending, or collateral-based lending, is a fast, temporary loan. A bridge loan is a temporary financing option. It is designed to help homeowners “bridge” the gap between the sale of an existing home and the purchase of a new. Bridge financing is a short-term loan used by businesses to cover temporary cash flow gaps until permanent funding is secured. A bridge loan is a short-term loan used to bridge the gap between buying a home and selling your previous one. Bridge financing, also called a bridge loan, is a way to help bridge the gap between closing on your current house and your new place. Bridge loans are intended to fill a gap until long-term financing can be obtained. However, there is significant risk associated with the short-term funding. Bridge financing (often called a bridge loan) is a short-term financial solution designed to bridge the gap between immediate funding needs and long-term. In the broadest definition, the term bridge loan is commonly referred to as: A short-term loan providing temporary financing until permanent financing can be. According to the bridge loan business definition, this type of financing is defined by its use as funding for immediate purchases. Commercial bridge loans can “. In the context of real estate, a bridge loan, sometimes referred to as hard money, private lending, or collateral-based lending, is a fast, temporary loan. A bridge loan is a temporary financing option. It is designed to help homeowners “bridge” the gap between the sale of an existing home and the purchase of a new. Bridge financing is a short-term loan used by businesses to cover temporary cash flow gaps until permanent funding is secured. A bridge loan is a short-term loan used to bridge the gap between buying a home and selling your previous one.

A bridge loan is a short-term loan startups can use to secure permanent financing or remove an existing obligation. Bridge loan is a type of gap financing arrangement wherein the borrower can get access to short-term loans for meeting short-term liquidity requirements. A bridge loan, also known as a bridging or swing loan, is temporary financing for individuals while they wait for permanent financing. It essentially bridges. Define Bridge Finance. means any Final Recipient Transaction that includes working capital financing and where the purpose is to provide short-term interim. A bridge loan is short-term financing used until a person or company secures permanent financing. It provides immediate cash flow. A bridge loan is a short-term loan used to purchase assets or cover immediate costs until long-term financing can be secured. Bridge loans are commonly used. A bridge loan is a form of short-term financing designed to bridge the gap until more permanent or subsequent financing can be secured. Commonly. A bridge loan is a short-term loan used until a borrower secures permanent, long-term financing. Also sometimes referred to as bridge financing. Bridge financing is a temporary financing solution, used to cover a company's short-term costs until it secures long-term financing options. In Canada, bridge financing is a short-term loan that allows you to put a large down payment on your new house before selling your previous one. bridge loan. A bridge loan is a short-term mortgage secured by a portion of the equity in your current home, even if it's for sale, to use toward the down payment on a new. A bridge loan is a source of short-term financing until the borrower secures long-term financing or removes an existing credit facility altogether. A bridge loan is a short-term form of financing that is used to meet current obligations before securing permanent financing. A bridge loan is a type of short-term loan, typically taken out for a period of 2 weeks to 3 years pending the arrangement of larger or longer-term. In Canada, bridge financing is a short-term loan that allows you to put a large down payment on your new house before selling your previous one. bridge loan. In some cases, it might include an equity-for-capital exchange instead of a loan money. Other than being beneficial to borrowers, bridge loans can also benefit. A bridge loan is short-term financing tool used to help a borrower pull equity from an existing property to help purchase a new property. Once the new property. A bridge loan is a type of short-term loan designed to fill a gap in financing. Let's say you're trying to buy a new home before you've sold your previous one. A bridge loan is a short-term loan that's used to bridge the gap between buying a new home and selling your current one. A bridging loan is a short-term loan used to help you 'bridge the gap' when you want to buy something, but you're waiting for funds to become available from.

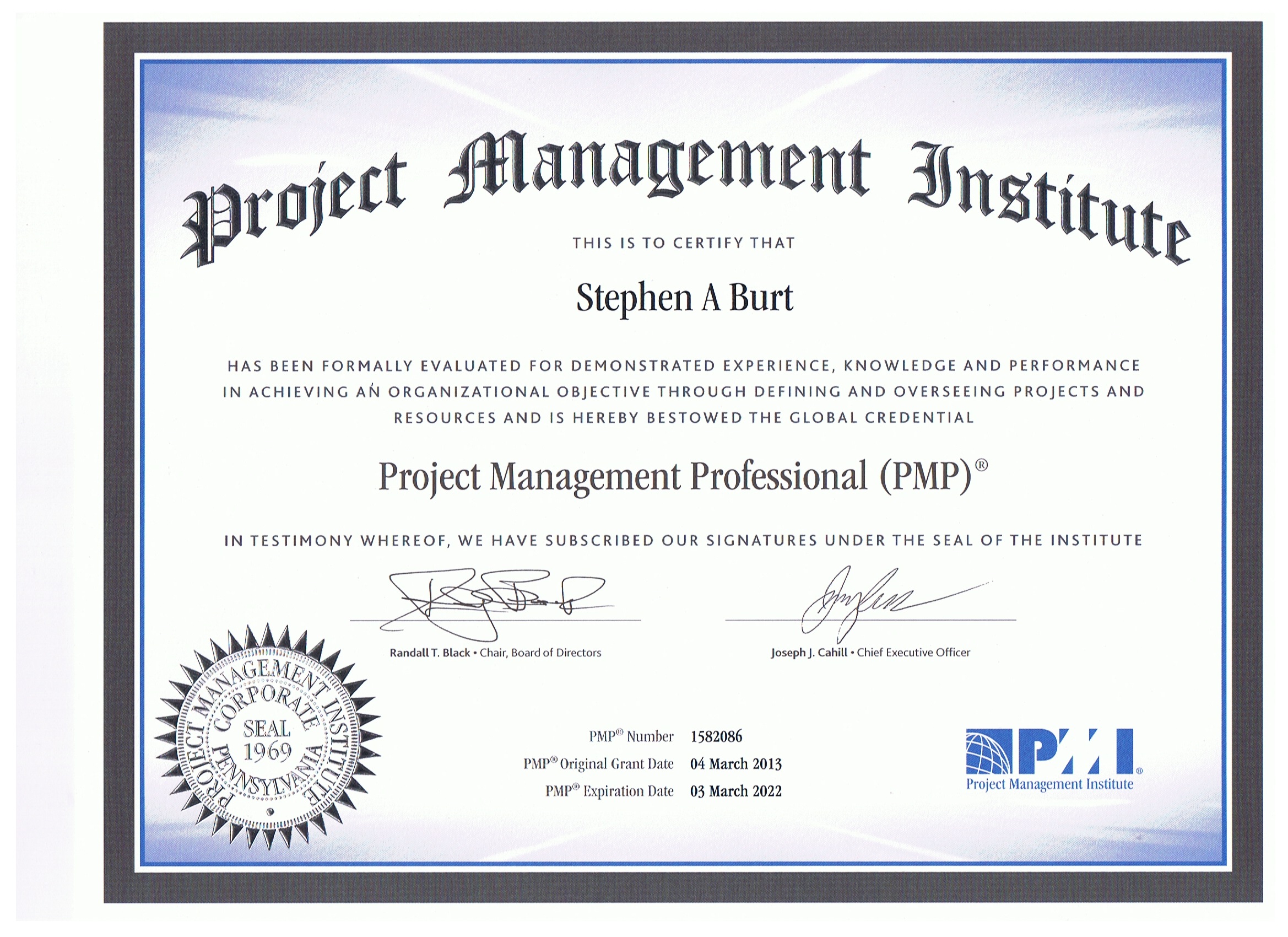

Pmi Certified

PMI currently offers eight certifications. For the purpose of this article, we will consider half of them to be general project management certifications. Peruse the certification options below to identify what is the best way for you to start the journey to professional development. PMI eLearning offers online learning courses in project management, agile basics, and more. Explore our offerings and discover what they can do for you. PMI is the world's largest non-profit membership association for the Project Management professional. Start your PMI Training with IPM for success in. Explore a range of PMI certifications like PMP®, PMI Risk Management Professional (PMI-RMP), PMI Agile Certified Practitioner (PMI-ACP), and more. These. Certifications. Project Management Professional (PMP)® · Certified Associate in Project Management (CAPM)® · PMI Agile Certified Practitioner (PMI-ACP)®. Their certifications empower you to work in any industry and with any project management methodology. Learn more about PMI's certifications and see which one is. With this certification, students will be prepared for entry-level jobs such as project coordinator, event planner, and project team member and be on the. The PMI® Authorized Training Partner Program is designed to help you find high-quality training for the PMI® project management certification exam. PMI currently offers eight certifications. For the purpose of this article, we will consider half of them to be general project management certifications. Peruse the certification options below to identify what is the best way for you to start the journey to professional development. PMI eLearning offers online learning courses in project management, agile basics, and more. Explore our offerings and discover what they can do for you. PMI is the world's largest non-profit membership association for the Project Management professional. Start your PMI Training with IPM for success in. Explore a range of PMI certifications like PMP®, PMI Risk Management Professional (PMI-RMP), PMI Agile Certified Practitioner (PMI-ACP), and more. These. Certifications. Project Management Professional (PMP)® · Certified Associate in Project Management (CAPM)® · PMI Agile Certified Practitioner (PMI-ACP)®. Their certifications empower you to work in any industry and with any project management methodology. Learn more about PMI's certifications and see which one is. With this certification, students will be prepared for entry-level jobs such as project coordinator, event planner, and project team member and be on the. The PMI® Authorized Training Partner Program is designed to help you find high-quality training for the PMI® project management certification exam.

This course prepares you to pass the PMP exam on your first attempt with an instructor-led PMP Exam Prep Training course with a % money-back guarantee. The PMI certification offers you the opportunities to work in any industry around the globe with any project management methodology. uCertify's PMI exams prep. PMI Project Management Certifications · Project Management Professional (PMP) · Program Management Professional (PgMP) · Portfolio Management Professional (PfMP). Pursue PMP certification from the Project Management Institute (PMI) with Purdue University's Project Management Essentials and PMP Exam Preparation. The PMI® Authorized On-Demand Certified Associate in Project Management (CAPM)® Exam Prep Course is the official PMI course for the CAPM exam. PMP Certification Training Course Benefits for individuals: Any individual who obtains & maintains PMI credentials, not only get recognized for his skills &. MPUG helps you maintain your PMI certification year after year. MPUG members can earn PDUs by completing any of our live and on-demand training Webinars. Join millions of learners and take a Udemy Project Management Professional PMP prep course for the Project Management Institute's PMP certification exam. Find an Authorized Training Partner Course. This certification is ideal for project managers and team members who work in agile environments or those who want to adopt agile methodologies in their. We advance careers, improve organizational success and further mature the project management profession through globally-recognized standards, certifications. There are two tiers to the PMI Authorized Training Partner program: Basic and Premier. If you teach PDU-eligible courses, join our Basic tier. Or, to gain all. PMP certification is a globally recognized credential offered by the Project Management Institute (PMI). Beginning the journey to earn your PMP. Certifications. Project Management Professional (PMP)® · Certified Associate in Project Management (CAPM)® · PMI Agile Certified Practitioner (PMI-ACP)®. The PMI Agile course will teach you to use an Agile approach to effectively manage a project's schedule, scope, budget, quality, and team. Additionally, you. Includes 21 PMI hours needed to take the PMI-ACP certification exam; 90 PMI Agile Certified Practitioner (PMI-ACP)®. Certified ScrumMaster®. Certified. Some Agile and Scrum certifications expire if not renewed every 2 years, which is simply a money-making racket. Learn why I let my. Designed by project managers for project managers, Project Management Professional (PMP) certification is a globally-recognized project management certification. This Six Sigma Green Belt Certification course is accredited by internationally recognized Continuing Professional Development (CPD) Certification Service. PMI Risk Management Professional (PMI-RMP)®. PMI-RMP® certification demonstrates knowledge and expertise in the specialized area of assessing and identifying.

401k Loan To Invest In Stocks

This assumes you have at least 10 years before retirement, that you're investing in a balanced portfolio with about a 50% allocation to stocks, and that you're. Let's keep your finances simple. Insure what you have. Invest when you're ready. Retire with confidence. A (k) loan is generally preferable to a (k) withdrawal if you must use the funds in your retirement accounts to meet your immediate needs. Investing involves risk. There is always the potential of losing money when you invest in securities. Past performance does not guarantee future results. Asset. Taking a (k) loan means borrowing money from your retirement savings account. You can usually borrow up to $50,, which must be repaid. Age-based target date funds are the default investment option for the (k) / plans. Participating members who do not specify an investment choice will be. The amount you can borrow varies depending on the investments you hold, but it is typically 30% to 50% of your total portfolio. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. 3 reasons to think twice before taking money out of your (k) · 1. You could face a high tax bill on early withdrawals · 2. You can be on the hook for a (k). This assumes you have at least 10 years before retirement, that you're investing in a balanced portfolio with about a 50% allocation to stocks, and that you're. Let's keep your finances simple. Insure what you have. Invest when you're ready. Retire with confidence. A (k) loan is generally preferable to a (k) withdrawal if you must use the funds in your retirement accounts to meet your immediate needs. Investing involves risk. There is always the potential of losing money when you invest in securities. Past performance does not guarantee future results. Asset. Taking a (k) loan means borrowing money from your retirement savings account. You can usually borrow up to $50,, which must be repaid. Age-based target date funds are the default investment option for the (k) / plans. Participating members who do not specify an investment choice will be. The amount you can borrow varies depending on the investments you hold, but it is typically 30% to 50% of your total portfolio. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. 3 reasons to think twice before taking money out of your (k) · 1. You could face a high tax bill on early withdrawals · 2. You can be on the hook for a (k).

Consider your options carefully before borrowing from your retirement plan. In particular, avoid using a (k) debit card, except as a last resort. Money you. Don't forget that a (k) loan may give you access to ready cash, but it's actually diminishing your retirement savings. First, you may have to sell stocks or. Many employers have limits for how much of your balance you're allowed to borrow and how many loans you can take from your account per year — you'll need to. k loans are meant for personal financial emergencies, not investment opportunities. It is an imprudent decision to unnecessarily burden. Most (k) plans allow you to borrow up to 50% of your vested funds for up to five years, at low interest rates, and you're paying that interest to yourself. The amount you can borrow varies depending on the investments you hold, but it is typically 30% to 50% of your total portfolio. Typically, you may borrow up to $50, or 50% of your assets (whichever is less), and the loan is tax-free. That money, plus interest, must be returned to the. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. With a (k) loan, you borrow money from your employer retirement plan and pay it back over time. (Employers aren't required to allow loans, and some may limit. One feature many people don't realize about (k) funds is that the account holder can borrow against the balance of the account. About 87% of funds offer this. Yes, you can borrow from your (k) plan to start a business, but only if your program administrator allows you to take out a loan. 1. You can borrow up to $50, or 50% of your vested balance. · 2. You typically have five years to repay the loan. · 3. Not all (k) plans will allow you to. A home equity loan borrows against the equity built in your home. Home equity can be accessed in the form of a loan or a line of credit. If you are a planning a. A (k) loan allows you to borrow from the balance you've built up in your retirement account. Generally, if allowed by the plan, you may borrow up to 50%. Bond - A bond acts like a loan or an IOU that A growth fund manager will typically invest in stocks with earnings that outperform the current market. If your (k) account is invested 70% in a stock mutual fund and 30% in a fixed-income mutual fund, the assets will be sold in the same proportions. The loan. Voya Investment Management is one of the 50 largest institutional asset managers globally*, providing differentiated solutions across fixed income, equity and. Use for a real estate investment, business startup, or other expense; cannot be used for buying securities or paying down margin loans. Understand a Pledged. A multi-asset strategy combines different types of assets – stocks, bonds, real estate, or cash for example – to create a more nimble and broadly diversified. As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your.

Messi Crypto Contract

Lionel Messi, the Argentine soccer superstar, has opted to receive cryptocurrency as part of his new contract signed with the French club. The popular football Player Lionel Messi recently signed a contract with Paris Saint Germain. The contract, which will run for two years, comes with many. Overview of Lionel Messi Fan Token (MESSI) Token smart contract 0x67f74dcab8a02db4d6baf11eb4a in Binance (BNB) Smart Chain Mainnet. Football legend Lionel Messi signed a two-year contract with Paris Saint-Germain (PSG) this week, and received a “large number” of the team's crypto fan. Football icon Lionel Messi's contract in his move to French club Paris Saint-Germain includes a payment in crypto currency fan tokens, a source close to the. By utilizing Ethereum's smart contract functionality, the Messi Coin establishes a reliable and immutable ledger for all transactions and interactions related. Lionel Messi's welcome bonus to Paris St Germain will be paid in part with the club's fan cryptocurrency, the PSG token. Lionel Messi has signed a contract worth over $20 million with the digital fan token company cazinobitcoin.site, However, the three-year deal doesn't. JAKARTA - Lionel Messi's contract fee at Paris Saint-Germain is partly in the form of the French club's cryptocurrency, which is named a fan token. Lionel Messi, the Argentine soccer superstar, has opted to receive cryptocurrency as part of his new contract signed with the French club. The popular football Player Lionel Messi recently signed a contract with Paris Saint Germain. The contract, which will run for two years, comes with many. Overview of Lionel Messi Fan Token (MESSI) Token smart contract 0x67f74dcab8a02db4d6baf11eb4a in Binance (BNB) Smart Chain Mainnet. Football legend Lionel Messi signed a two-year contract with Paris Saint-Germain (PSG) this week, and received a “large number” of the team's crypto fan. Football icon Lionel Messi's contract in his move to French club Paris Saint-Germain includes a payment in crypto currency fan tokens, a source close to the. By utilizing Ethereum's smart contract functionality, the Messi Coin establishes a reliable and immutable ledger for all transactions and interactions related. Lionel Messi's welcome bonus to Paris St Germain will be paid in part with the club's fan cryptocurrency, the PSG token. Lionel Messi has signed a contract worth over $20 million with the digital fan token company cazinobitcoin.site, However, the three-year deal doesn't. JAKARTA - Lionel Messi's contract fee at Paris Saint-Germain is partly in the form of the French club's cryptocurrency, which is named a fan token.

Lionel Messi has signed a contract worth over $20 million with the digital fan token company cazinobitcoin.site, However, the three-year deal doesn't. If you haven't understood what this event has to do with cryptocurrencies, we're getting to that. According to Reuters, part of Messi's transfer agreement. That deal with Socios is worth US$20 million spread over three years, as per reports. Bitget too has entered the world of crypto with partnerships. The exchange. Yesterday, the famous Argentine soccer player Leo Messi promoted crypto on Solana in his Instagram stories. It's called Water. It's a meme coin of Solana. Lionel Messi has reportedly signed a multi-million three-year deal with cryptocurrency fan company Socios ahead of the Qatar World Cup. JAKARTA - Lionel Messi's contract fee at Paris Saint-Germain is partly in the form of the French club's cryptocurrency, which is named a fan token. Overview of Lionel Messi Fan Token (MESSI) Token smart contract 0x67f74dcab8a02db4d6baf11eb4a in Binance (BNB) Smart Chain Mainnet. Football legend Lionel Messi signed a two-year contract with Paris Saint-Germain (PSG) this week, and received a “large number” of the team's crypto fan. Within days, Messi had found a new home in a two-year deal (with a third year option) with Paris Saint-Germain (PSG). There's no time like the present for fan. Lionel Messi, the Argentine soccer superstar, has opted to receive cryptocurrency as part of his new contract signed with the French club. Today's Top Crypto News Stories · Soccer Legend Messi's New Contract Includes Fan Tokens ⚽ · $M Poly Network Hacker Returning Funds, Preening Ego · Within days, Messi had found a new home in a two-year deal (with a third year option) with Paris Saint-Germain (PSG). There's no time like the present for fan. Football icon Lionel Messi's contract in his move to French club Paris Saint-Germain includes a payment in crypto currency fan tokens, a source close to the. Lionel Messi has reportedly signed a multi-million three-year deal with cryptocurrency fan company Socios ahead of the Qatar World Cup. Argentinian soccer legend Lionel Messi's new contract with Paris Saint Germain includes payment in the club's cryptocurrency fan token, $PSG. Chiliz, which. The popular football Player Lionel Messi recently signed a contract with Paris Saint Germain. The contract, which will run for two years, comes with many. JAKARTA - Lionel Messi's contract fee at Paris Saint-Germain is partly in the form of the French club's cryptocurrency, which is named a fan token. Lionel Messi's welcome bonus to Paris St Germain will be paid in part with the club's fan cryptocurrency, the PSG token. The contract is being signed with Inter Miami, not with Messi. Two r/CryptoCurrency - cazinobitcoin.site becomes official UEFA Champions League. Lionel Messi, the Argentine soccer superstar, has opted to receive cryptocurrency as part of his new contract signed with the French club.

Is Lendingtree A Legitimate Company

Based on user reviews, lenders, and available products, we rate LendingTree at out of 5. The application process and lender network make it an attractive. LendingClub is headquartered in LEHI and is the 12th largest bank in the state of Utah. It is also the th largest bank in the nation. Nothing but a bunch of rude scammers. Lendingtree % sells all your information to whoever they can. I get 40+ phone calls per day from pushy lenders who don'. It's a highly reputable company with solid customer reviews — although it's difficult to identify those related specifically to business finance. The website is. We think cazinobitcoin.site is legit and safe for consumers to access. Scamadviser is an automated algorithm to check if a website is legit and safe (or not). The. 8 warning signs of a debt consolidation scam · You're asked for an upfront payment · The company pressures you to act fast · The company contacts you first with an. LendingTree has had a Better Business Bureau file since As of January , it was not BBB Accredited and had a rating of A-. Out of BBB closed. company serves. Loans not offered in all 50 states: LendingPoint does not Is LendingPoint a legitimate lender? Yes — LendingPoint is a legitimate. So if you're wondering “is LendingTree good at helping customers with loans?” the answer is an easy YES. But the Company is not here to simply give you a loan. Based on user reviews, lenders, and available products, we rate LendingTree at out of 5. The application process and lender network make it an attractive. LendingClub is headquartered in LEHI and is the 12th largest bank in the state of Utah. It is also the th largest bank in the nation. Nothing but a bunch of rude scammers. Lendingtree % sells all your information to whoever they can. I get 40+ phone calls per day from pushy lenders who don'. It's a highly reputable company with solid customer reviews — although it's difficult to identify those related specifically to business finance. The website is. We think cazinobitcoin.site is legit and safe for consumers to access. Scamadviser is an automated algorithm to check if a website is legit and safe (or not). The. 8 warning signs of a debt consolidation scam · You're asked for an upfront payment · The company pressures you to act fast · The company contacts you first with an. LendingTree has had a Better Business Bureau file since As of January , it was not BBB Accredited and had a rating of A-. Out of BBB closed. company serves. Loans not offered in all 50 states: LendingPoint does not Is LendingPoint a legitimate lender? Yes — LendingPoint is a legitimate. So if you're wondering “is LendingTree good at helping customers with loans?” the answer is an easy YES. But the Company is not here to simply give you a loan.

Yes. LendingTree's insurance comparison tool is completely free to use. Its revenue comes from generating leads for partnering companies. Is LendingTree a. was founded in , it is a well-established company that has been in business for 28 years. LendingTree Personal Loans are strongly not recommended by. LENDINGTREE, Rushmore Dr, Charlotte, NC ⭐ 4 Reviews Phone By the way, the legit Lending Tree Company were amazing. Look for the leaf. company you already do business with. Learn about the advance fee scam. Personal LoansPersonal BankingAuto RefinancingPatient SolutionsBusiness LoansBusiness. Like previous comments have said, they are a scam, eager to sell your contact information to fictitious companies that call claiming you've been approved for. Is LendingTree a legitimate mortgage company? LendingTree is a legitimate way to get a mortgage loan―but remember that LendingTree isn't a mortgage lender. company serves. Loans not offered in all 50 states: LendingPoint does not Is LendingPoint a legitimate lender? Yes — LendingPoint is a legitimate. LendingTree is 19 out of 26 best companies in the category Bank on Trustpilot · LendingTree is out of best companies in the category Financial Consultant. I will go to them in the future before I search for a company on my own. Perfect place to shop, compare rates and speak to potential Lenders. Both were legit. LendingTree is partnered with over financial institutions worldwide. Over 15 million active users use LendingTree to monitor their credit, shop for loans. Lending Tree is most certainly not a scam. They provide loans to thousands of clients annually and have been doing so for years. They are a. How Does LendingTree Get Paid? LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this. LendingTree offers typical consumer home loans backed by the FHA, VA, private banks, etc., so lenders like the federal government itself are legit. Is. LendingTree's goal is to save people money by making it easier to find the For the residents of the state of Georgia only: Regional Finance Company of Georgia. In general, loan forgiveness companies are not legitimate. While there are plenty of honest personal loan companies, there are also personal loan scams to keep. Yes, Lendingtree Inc is a legit online marketplace and a public company listed on NASDAQ under the ticker TREE. Is LendingTree a direct lender? No. OppLoans has an A+ rating from the Better Business Bureau and is highly rated on Trustpilot and LendingTree for our unmatched customer service. OppLoans has. reviews and 8 photos of LENDINGTREE "Stay away from these people. They are a scam. In advertizing they claim they will obtain competing offers for. I will go to them in the future before I search for a company on my own. Perfect place to shop, compare rates and speak to potential Lenders. Both were legit. OppLoans has an A+ rating from the Better Business Bureau and is highly rated on Trustpilot and LendingTree for our unmatched customer service. OppLoans has.

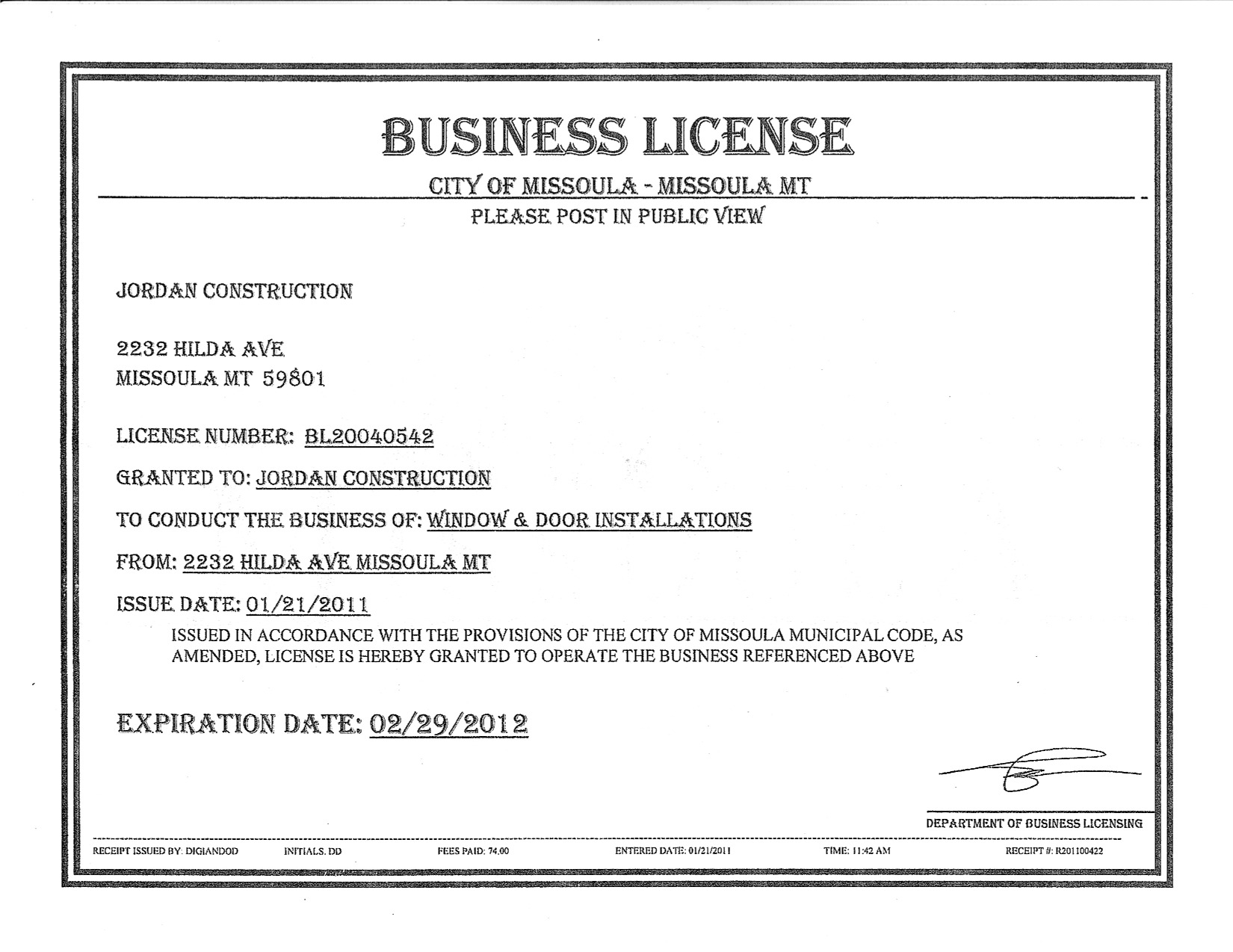

How Much Is A Business License In Iowa

You are not obligated to pay this fee online. Other payment options include: By mail or in person: City of Bettendorf Attn: Account Receivable State St. Our intention is to be able to provide as much information as possible. Iowa Business License Center (Resource page by the State of Iowa). Liquor. To form an LLC in Iowa, you'll start out by paying $50 to register your business with the Secretary of State. After that, you'll need to pay $ dollars. Business Licenses. The City of Cedar Falls does not currently require a license for most standard businesses. However, business licenses are required for the. Iowa City does not require a general business license. However, some An annual license renewal fee is required. Contact: Johnson County Department. We ask this question of our clients so that you know how much money you State – Iowa does not have a general business permit or license requirement. Licenses expire on January 31 of each year and have an annual fee of $ Pawnbroker. Person who makes loans or advancements upon pawn, pledge, or deposit of. Business Licenses. Business License The City of Storm Lake does not require business licenses; however, there are a number of key issues for new businesses. Business license costs in the U.S. vary by city and county, and are typically around $ States use them to track taxes on revenue — learn more here. You are not obligated to pay this fee online. Other payment options include: By mail or in person: City of Bettendorf Attn: Account Receivable State St. Our intention is to be able to provide as much information as possible. Iowa Business License Center (Resource page by the State of Iowa). Liquor. To form an LLC in Iowa, you'll start out by paying $50 to register your business with the Secretary of State. After that, you'll need to pay $ dollars. Business Licenses. The City of Cedar Falls does not currently require a license for most standard businesses. However, business licenses are required for the. Iowa City does not require a general business license. However, some An annual license renewal fee is required. Contact: Johnson County Department. We ask this question of our clients so that you know how much money you State – Iowa does not have a general business permit or license requirement. Licenses expire on January 31 of each year and have an annual fee of $ Pawnbroker. Person who makes loans or advancements upon pawn, pledge, or deposit of. Business Licenses. Business License The City of Storm Lake does not require business licenses; however, there are a number of key issues for new businesses. Business license costs in the U.S. vary by city and county, and are typically around $ States use them to track taxes on revenue — learn more here.

Get your business up and running smoothly with our streamlined custom business license services in Iowa. Our experts ensure hassle-free compliance. How to get a business license in Iowa · Obtain financing · Set up a business entity and choose a business name · Register your new business with the Iowa. Contact the Des Moines City Clerk's Office to apply for beer and liquor licenses, tobacco permits, mobile vender permits, peddler permits and other required. Certain business licenses are issued at city hall, such as tree trimmers, peddlers, mobile food vendors and solid waste collectors. For a mobile food vendor. IASourceLink provides an easy-to-search database of all licensing requirements through the Business License Information Center. Through IASourceLink, more. Alcohol License Applications are obtained through the State of Iowa. Body Piercing Business License · Carnival, Circus, Exhibition, or Show License. The license requirement for many business types was removed from our Code of Ordinances in March including the following business types: Alarm Businesses. Although Iowa does not have a state-wide business license, businesses may need to obtain one or more licenses or permits for a range of business activities and. How much does a business license in Iowa cost? While there is no general business license in Iowa, the pricing for many of the additional permits and licenses. The formula to calculate the registration fee for electric vehicles is as follows: $ per hundred pounds of vehicle weight, plus a percentage of the vehicle. license applications prior to issuance by the Iowa Alcoholic Beverages Division. How long does it take to get a new business license? A business license. Which Business Licenses Do You Need for Your Small Business? · register your business entity with the Iowa Secretary of State (SOS) · file taxes with the Iowa. Fee $ annually · Approvers: Forestry, Finance · Licenses are not transferable · Bond Required · Liability insurance required · Compliance with Iowa Workmen's. The Iowa Constitution grants municipal corporations, counties, and joint municipal-county corporations home-rule power and authority to determine their. Get more information about business-related licenses and permits and how to get one for your business. To obtain a business-related license or permit, please. The State of Iowa also doesn't require a general Iowa state business license. However, that doesn't mean your city or county won't require one. Therefore. Other Licenses · This license is required for any person engaging as a manager for an adult entertainment business. · $ per manager application fee · Due. License & Permits. The City Clerk's office issues many types of permits and licenses. The following is a listing of Licenses and Permits that are required by. The fee varies from $ – $ depending on annual gross sales. Outdoor Service Area Privilege: If you wish to start a full service restaurant and allow. Business Licenses. Licenses The City of Burlington does not require business licenses; however it is recommended that you check with the Building Inspector to.

Symbol For Nasdaq Index

Discover real-time NASDAQ Composite Index (COMP) share prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Analyze the Fund Fidelity ® NASDAQ Composite Index ® Fund having Symbol FNCMX for type mutual-funds and perform research on other mutual funds. Find the latest NASDAQ Composite (^IXIC) stock quote, history, news and other vital information to help you with your stock trading and investing. Get NASDAQ Index .NDX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The Nasdaq Composite Index is a broad-based market index that includes more than stocks listed on the Nasdaq stock exchange. Top Indexes ; COMP NASDAQ Composite Index. 17, ; NYA NYSE Composite. 19, ; SPX S&P 5, ; RUT Russell 2, ; NDX NASDAQ 19, The Nasdaq® is one of the world's preeminent large-cap indexes. Discover important NDX® market cap info & how you can begin investing in innovation. The Nasdaq (^NDX) is a stock market index made up of equity securities issued by of the largest non-financial companies listed on the Nasdaq stock. Interactive Chart for NASDAQ Composite (^IXIC), analyze all the data with a huge range of indicators. Discover real-time NASDAQ Composite Index (COMP) share prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Analyze the Fund Fidelity ® NASDAQ Composite Index ® Fund having Symbol FNCMX for type mutual-funds and perform research on other mutual funds. Find the latest NASDAQ Composite (^IXIC) stock quote, history, news and other vital information to help you with your stock trading and investing. Get NASDAQ Index .NDX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The Nasdaq Composite Index is a broad-based market index that includes more than stocks listed on the Nasdaq stock exchange. Top Indexes ; COMP NASDAQ Composite Index. 17, ; NYA NYSE Composite. 19, ; SPX S&P 5, ; RUT Russell 2, ; NDX NASDAQ 19, The Nasdaq® is one of the world's preeminent large-cap indexes. Discover important NDX® market cap info & how you can begin investing in innovation. The Nasdaq (^NDX) is a stock market index made up of equity securities issued by of the largest non-financial companies listed on the Nasdaq stock. Interactive Chart for NASDAQ Composite (^IXIC), analyze all the data with a huge range of indicators.

Summary of Nasdaq Composite Stocks With New Highs and Lows For less than $10 per month, a Barchart Plus Membership lets you pull these symbols into the. Today the NASDAQ Composite includes over 2, companies, more than most other stock market indexes. ETF. Name, Symbol, Sponsor. Fidelity Nasdaq Composite. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. Like the Swiss Market Index (SMI), the Nasdaq is a price index. The shares included in it are weighted according to market capitalization; the index level. Free Stock Quotes Nasdaq Amex NYSE, Options and Mutual Funds, Investment information, Portfolio Tracking, Ticker. All rights reserved. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. COMP | A complete NASDAQ Composite Index index overview by MarketWatch. View stock market news, stock market data and trading information. Like the Swiss Market Index (SMI), the Nasdaq is a price index. The shares included in it are weighted according to market capitalization; the index level. Index performance for NASDAQ Composite Index (CCMP) including value, chart, profile & other market data. View live Nasdaq Index chart to track latest price changes. NASDAQ:NDX trade ideas, forecasts and market news are at your disposal as well. Thanks, NDX is for Nasdaq and I do have /nq for futures. I was using COMP as the symbol for overall nasdaq composite and that changed Friday. The Symbol Lookup provides access to All Issues (NASDAQ and Other Exchanges), Nasdaq Fund Network, and Market Participants. All information is as of the current. NASDAQ Composite Index ; Open. 17, Previous Close17, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range12, - 18, NASDAQ Comp. Today: Get all information on the NASDAQ Comp. Index including historical chart, news and constituents NASDAQ Composite IndexIndex, COMPX. More Options to Invest ; Root Ticker Symbol, NDX, NDXP ; AM or PM Settlement, AM-settled, PM-settled ; Approximate Notional Size, $1,,, $1,, ; Exercise. NASDAQ Composite Index (NASDAQCOM). Download. 17, NASDAQ disseminates intraday price data for the ABA NASDAQ Community Bank Index™, with assigned symbol ABAQ. The price is refreshed every second over the. Discover real-time Nasdaq, Inc. Common Stock (NDAQ) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. View live Nasdaq Composite Index chart to track latest price changes. NASDAQ:IXIC trade ideas, forecasts and market news are at your disposal as well.